Breaking Down Financial Myths

We've all been handed financial "truths" that don't stand up to reality. These myths often come from trusted sources—parents, mentors, even bestselling authors.

Outdated Wisdom

Many financial rules were created for a different economic era. Today's economy requires different strategies.

Hidden Agendas

Some common advice benefits banks and financial institutions more than your personal bottom line.

Wealth Roadblocks

These accepted "truths" can actually prevent wealth accumulation, creating financial stagnation instead.

"Buying a Home Is Always a Good Investment"

For decades, many people have been taught that buying a home is one of the best financial decisions you can make. While real estate can be a valuable asset, buying a home isn't always a guaranteed path to wealth.

Home as a Liability

Kiyosaki challenges the conventional wisdom, pointing out that a home is often not an income-generating asset but a liability due to ongoing expenses like maintenance, insurance, and taxes.

Income-Generating Properties

Instead of locking yourself into a mortgage with no guaranteed return, consider investing in properties that generate rental income while potentially appreciating over time.

Alternative Strategy

Focus on cash flow from investment properties rather than hoping for appreciation on your primary residence. This approach can build wealth while providing ongoing income.

"Get a High-Paying Job and Save Money"

While earning a high income can certainly help your financial situation, the idea of saving money in a traditional savings account is not the best strategy for wealth-building. With low interest rates and inflation eating away at your savings, you may actually be losing money over time by holding it in a bank.

Alternative Strategy:

Focus on building assets that generate passive income, such as real estate, dividend-paying stocks, or even creating your own business. These assets have the potential to grow your wealth exponentially rather than just preserving it.

"Debt Is Always Bad"

- 1The advice to avoid debt at all costs is one of the most common financial beliefs, yet it often leaves people with fewer opportunities to leverage their money.

- 2Kiyosaki teaches that there are two types of debt: bad debt and good debt. While credit card debt or loans with high interest are harmful, strategic use of debt—such as borrowing to invest in real estate or a profitable business—can accelerate wealth creation.

- 3Alternative Strategy:

Instead of fearing debt, learn to use "good debt" to leverage investments. When used wisely, debt can be a powerful tool to grow wealth.

"Cutting Expenses Is the Key to Financial Freedom"

Many financial advisors preach the importance of cutting back on discretionary spending to save more money. While living within your means is essential, focusing solely on frugality might limit your ability to generate wealth.

Building wealth isn't just about cutting costs; it's about increasing your income and investing in growth opportunities.

Alternative Strategy:

Shift your mindset from "cutting expenses" to "increasing income." Invest in personal development, start side businesses, or look for opportunities to create value that can increase your earning potential over time.

"The Stock Market Is Too Risky"

Common Belief

It's easy to believe that the stock market is too volatile and risky for the average person.

Reality

When managed correctly, investing in stocks—especially in a diversified portfolio—can be a safe and effective way to build wealth over the long term.

Consequence

Avoiding the stock market out of fear could cost you significant gains in the future.

Alternative Strategy: Educate yourself on how to invest in stocks wisely. Look into low-cost index funds or exchange-traded funds (ETFs) to diversify your portfolio and reduce risk while still allowing for growth.

"Financial Success Takes Years of Hard Work"

1

Myth

It will take decades of hard work and saving to achieve financial success.

2

Reality

Building wealth requires effort, but smart strategies can accelerate the process.

3

Consequence

This mentality keeps many stuck in the rat race of working harder rather than smarter.

Alternative Strategy: Instead of relying solely on your labor, focus on building assets that work for you. Whether it's real estate, stocks, or businesses, invest in assets that generate income, allowing you to achieve financial success more quickly.

"You Need to Be Conservative with Your Investments"

Risk Aversion

Risk aversion is often encouraged, especially in conservative financial circles.

Low Returns

Avoiding risk entirely can leave you with minimal returns, especially in a low-interest environment.

Growth Opportunities

Kiyosaki encourages taking calculated risks and investing in assets that provide higher returns, such as real estate or business ventures.

Alternative Strategy: While you shouldn't be reckless, don't be afraid to take on calculated risks. Invest in growth opportunities, and understand that risk can be mitigated through research and diversification.

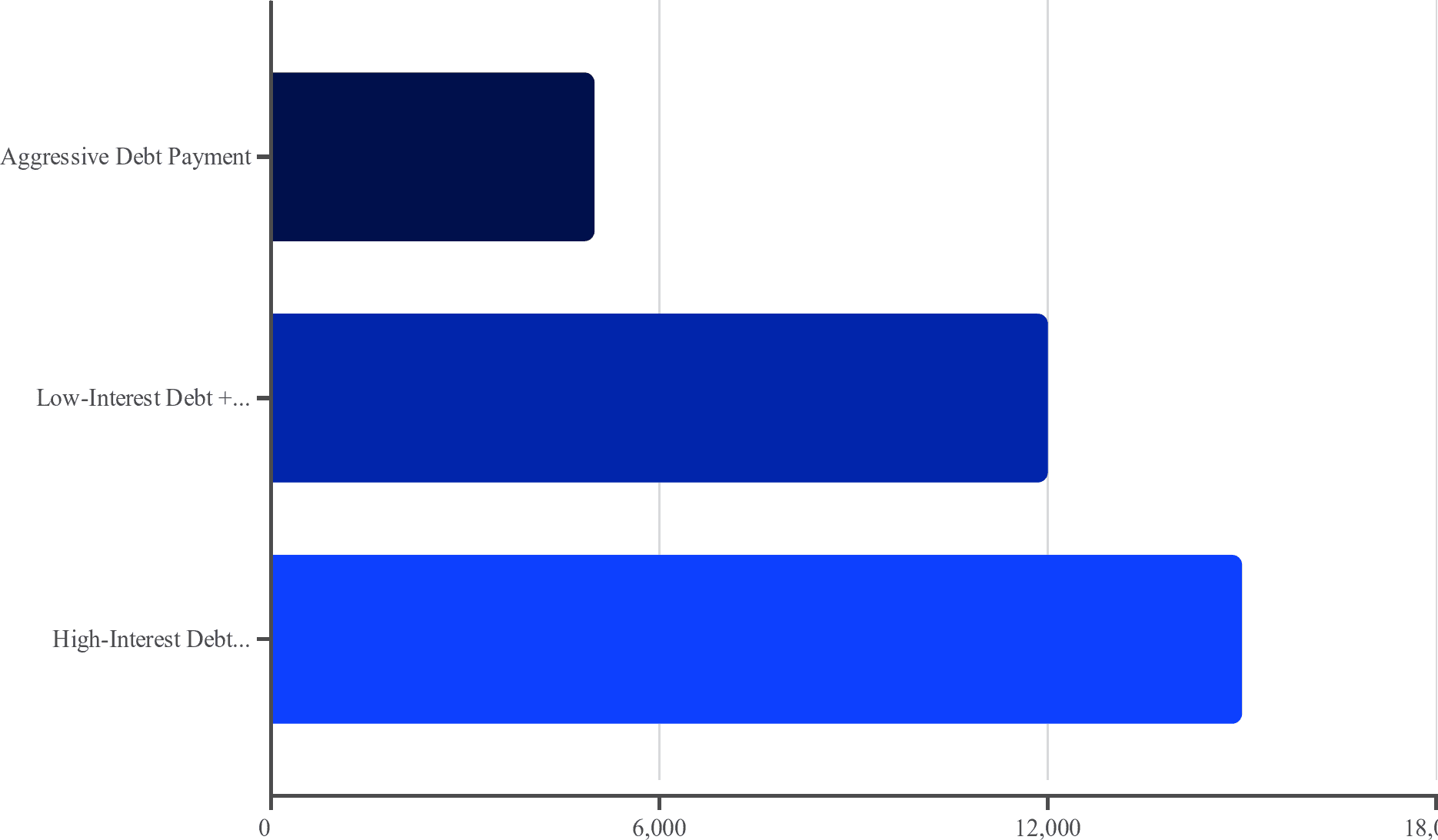

You Should Focus on Paying Off Debt Fast

The conventional wisdom of aggressive debt repayment can actually slow your wealth-building journey.

Smart money management means investing where returns outpace your debt interest rates.

Alternative Strategy: Prioritize high-interest debt while simultaneously investing for growth. Let your money work harder than your debt costs.

Breaking Financial Traps and Building Wealth

- 1These commonly held beliefs have been passed down for generations, but they can often keep you stuck in a cycle of financial struggle.

- 3By shifting your mindset and exploring alternative financial strategies—such as investing in real estate, using good debt wisely, and focusing on income-generating assets—you can begin breaking free from outdated financial traps.

- 2To truly build wealth, it's crucial to challenge traditional financial wisdom and embrace strategies that focus on growing assets and leveraging opportunities.

- 4Remember, wealth-building isn't about following the crowd; it's about making informed, strategic decisions that work in your favor.

Start Your Journey Toward Financial Freedom

Ready to break free from outdated financial wisdom? Join us at National Achievers Congress.

Learn wealth-building systems from experts who escaped the 9-to-5 trap.

Asset Building Strategies

Discover smarter approaches to creating income-generating investments.

High-Performance Network

Surround yourself with forward-thinking wealth creators.

Actionable Clarity

Walk away with concrete steps toward financial independence.

Secure Your Spot at the National Achievers Congress.

Step Into Your Next Financial Breakthrough

Success isn't accidental. It's built on mindset, knowledge, and environment.

At National Achievers Congress, world-renowned financial experts share wealth-building systems that freed them from the 9-to-5 grind.

Discover Asset-Building Strategies

Learn smarter approaches to creating income-generating investments.

Join a High-Performance Network

Surround yourself with forward-thinking wealth creators.

Gain Actionable Clarity

Walk away with concrete steps toward financial independence.

👉 Secure Your Spot at NAC – Click Here

But First... Are You Even Financially Ready?

Before challenging financial myths, assess your current financial position.

Take the Financial Freedom Readiness Quiz

This powerful tool uncovers your strengths and reveals your blind spots.

Evaluate Financial Habits

Discover which money behaviors are helping or hurting your wealth.

Pinpoint Growth Areas

Identify specific opportunities to improve your financial position.

Get Actionable Plans

Receive customized steps to start building authentic wealth today.

👉 Take the Free Quiz Now – Click Here

Lesson 6: The CASHFLOW Quadrant

- 1Employees (E)

Work for money

- 2Self-Employed (S)

Own a job

- 3Business Owners (B)

Build systems that make money

- 4Investors (I)

Make money work for them

Which quadrant are you in? Take a moment to reflect and start your journey to financial freedom.

Lesson 10: The 5 Asset Classes for Wealth

- 1Business

Work for money

- 2Real Estate

Rental properties, commercial spaces, and land appreciate in value and generate passive income

- 3Paper Assets

Stocks and bonds allow you to grow wealth through capital appreciation and dividends

- 4Commodities

Hard assets like gold, silver, and oil protect against inflation and serve as a store of value

- 5Digital Assets

Crypto and NFTs offer high-risk, high-reward opportunities in a decentralized world

Lesson 17: Learning from Mistakes

- 1Make Mistakes

Don't fear failure; it's part of the learning process

- 2Make Mistakes

Don't fear failure; it's part of the learning process

- 3Learn

Extract valuable lessons from each experience

- 4Adapt

Adjust your strategies based on what you've learned

- 5Grow

Use your new knowledge to make better financial decisions

The biggest financial success stories are built on failures. The key is learning, adapting, and growing from them.