The Power of Mindset in Wealth Building

You've probably heard the phrase "Your mindset is everything." While it may sound like motivational jargon, it's a truth that many successful people swear by, especially when it comes to building wealth. Whether you want to achieve financial freedom or just grow your savings, the journey doesn't begin with the latest investment strategies or a perfect business plan. It all starts with your mindset.

Your thoughts and beliefs about money, success, and your capabilities shape the financial decisions you make every day. If you think wealth is out of reach, chances are you'll struggle to achieve it. But if you cultivate a mindset geared toward abundance, opportunity, and growth, you'll naturally take actions that will move you toward financial freedom.

The Power of Belief in Financial Freedom

Belief Drives Action

If you don't believe that financial freedom is possible for you, you'll unknowingly sabotage your chances of achieving it. Belief is a powerful driver of action. When you believe in your ability to build wealth, you begin to make choices that support your goals, whether that means investing in education, seeking new income streams, or managing your finances more effectively.

Robert Kiyosaki's Perspective: Mindset Matters

- 1Financial Education and Mindset

Robert Kiyosaki, the author of Rich Dad Poor Dad, is a huge advocate for the importance of mindset in wealth-building. He frequently emphasizes that financial education and mindset are more important than relying on traditional strategies like saving money or focusing on getting a job. - 2Rich vs. Poor Thinking

According to Kiyosaki, rich people think differently than the poor, and this difference in thinking is what sets them apart. - 3Abundance Mindset

Kiyosaki's Rich Dad taught him to have an abundance mindset, to see money as a tool that can work for you, rather than something to hoard or fear. This shift in thinking allowed him to pursue investments in real estate, businesses, and assets that generated passive income—leading him to financial freedom. - 4Poor Dad's Mindset

In contrast, the mindset of Poor Dad focused on job security, saving, and avoiding risk, which often keeps people stuck in the cycle of working for money instead of making money work for them.

You Should Focus on Paying Off Debt Fast

Embrace the Growth Mindset

Understand that wealth-building is a journey. There will be ups and downs, but the key is to keep learning and growing. Every failure is a lesson in disguise. Embrace challenges, and remember that learning is just as important as success.

Replace Limiting Beliefs

Ask yourself: What are the beliefs you hold about money and success? Do you think wealth is only for the lucky few? Start to replace limiting beliefs with empowering ones. Wealth is not reserved for a select few—it's available to anyone who is willing to learn, grow, and take action.

Visualize Your Financial Goals

Take a moment to visualize what financial freedom looks like for you. Do you want to retire early? Build a business? Own real estate? The more vividly you can imagine your financial success, the more likely you'll be to take the steps necessary to achieve it.

Surround Yourself with Like-Minded People

The people you associate with influence your mindset. Surround yourself with individuals who think positively about money and wealth-building. Network with people who inspire you, offer valuable advice, and encourage your growth.

Commit to Continuous Learning

Financial freedom doesn't happen overnight, and neither does developing the right mindset. Commit to daily habits of learning. Read books, listen to podcasts, attend seminars, and seek out mentors who can guide you in the right direction. The more you learn, the more confident you'll become in your ability to make informed financial decisions.

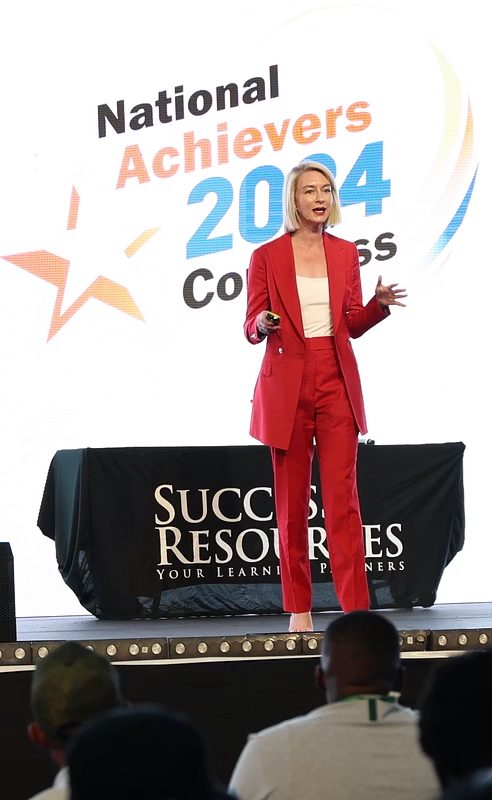

Real-World Example: Shani Taylor's Wealth-Building Mindset

Overcoming Personal Challenges

Shani Taylor, a global business coach and bestselling author, emphasizes the importance of mindset in creating wealth. Her own journey involved overcoming personal challenges, including addiction and PTSD, and shifting her mindset to achieve financial success.

Embracing Growth Mindset

By embracing a growth mindset and consistently working on her mental resilience, she turned her passion for business into a global coaching empire.

Transforming Obstacles into Opportunities

Taylor's story highlights how the right mindset can transform obstacles into opportunities. She encourages others to adopt the same mindset shift—viewing challenges not as barriers, but as stepping stones to greater success.

Your Mindset is Your Biggest Asset

Mindset as Foundation

Financial freedom starts with your mindset.

Changing Thought Patterns

No matter how many strategies or tips you learn, the first step is changing the way you think about money.

Embracing Abundance

By embracing an abundance mindset, believing in your ability to succeed, and taking consistent action, you can unlock the path to true wealth.

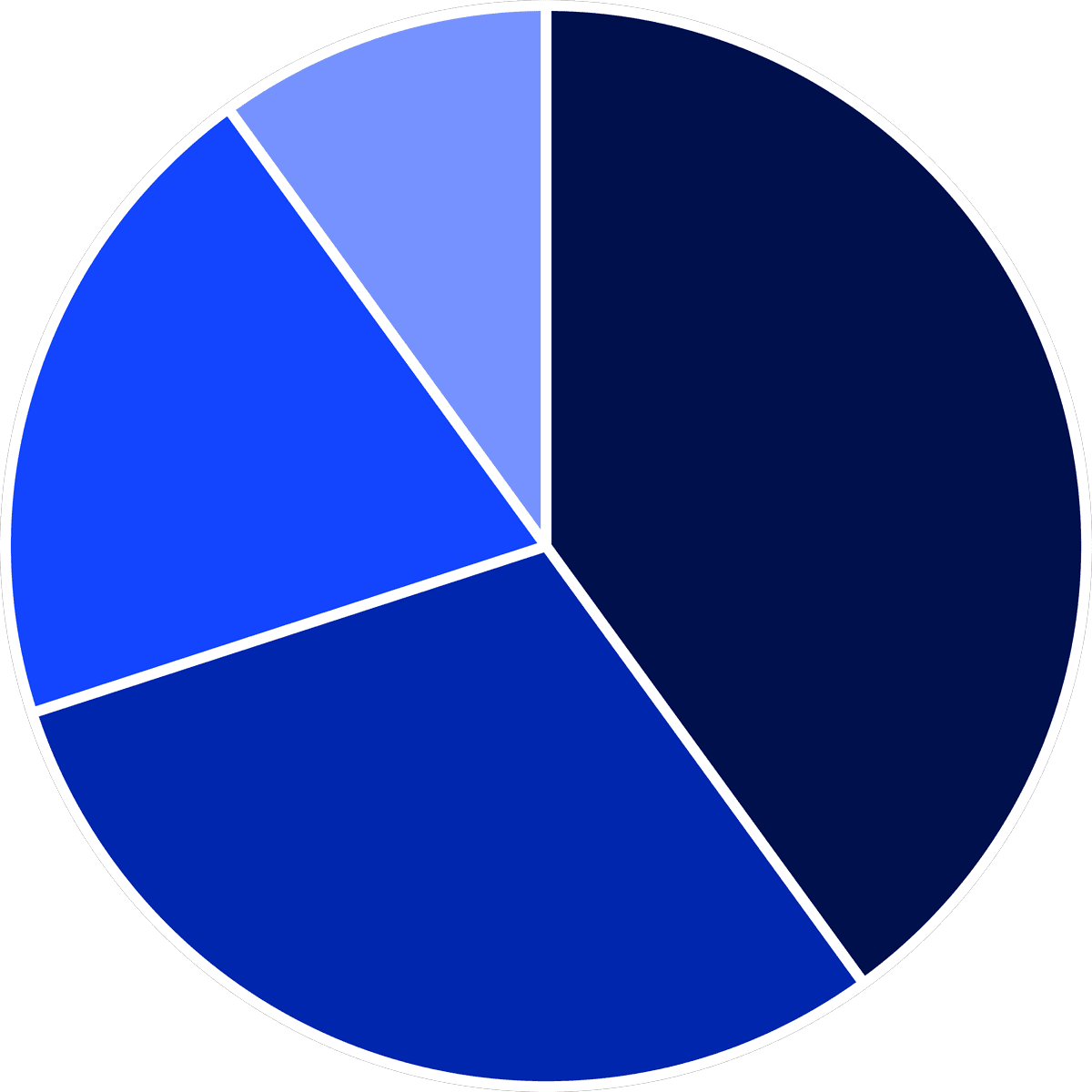

The Impact of Mindset on Financial Decision

This chart illustrates the significant impact that different mindsets can have on financial decisions. An abundance mindset and growth mindset together account for 70% of positive financial decision-making, highlighting their crucial role in achieving financial freedom.

Abundance Mindset

40%

Growth Mindset

30%

Positive Risk-Taking

20%

Scarcity Mindset

10%

Key Mindset Shifts for Financial Freedom

Embrace Continuous Learning

Commit to ongoing financial education and personal development.

Set Clear Financial Goals

Visualize and define your path to financial freedom.

Build a Supportive Network

Surround yourself with like-minded individuals who support your financial goals.

Cultivate an Abundance Mindset

Focus on opportunities and possibilities rather than limitations.

Frequently Asked Questions About Mindset and Wealth

Can changing my mindset really impact my financial situation?

Yes, changing your mindset can have a significant impact on your financial situation. Your mindset influences your decisions, actions, and how you perceive opportunities. By adopting a growth and abundance mindset, you're more likely to take calculated risks, seek out learning opportunities, and persist in the face of challenges - all of which can lead to improved financial outcomes.

How long does it take to shift from a scarcity mindset to an abundance mindset?

The time it takes to shift from a scarcity mindset to an abundance mindset can vary for each individual. It's a gradual process that requires consistent effort and practice. Some people may start noticing changes in their thinking patterns within a few weeks, while for others it might take several months. The key is to remain patient and persistent in challenging and replacing limiting beliefs with more empowering ones.

What are some practical ways to maintain a positive mindset about money?

Some practical ways to maintain a positive mindset about money include regularly practicing gratitude for your current financial resources, using affirmations and visualization exercises, educating yourself about personal finance, surrounding yourself with positive influences, and celebrating small financial wins and milestones along your journey.

- Regularly practicing gratitude for the financial resources you currently have

- Affirmations and visualization exercises focused on your financial goals

- Educating yourself about personal finance and wealth-building strategies

- Surrounding yourself with positive influences and like-minded individuals

- Celebrating small financial wins and milestones along your journey

Take Action: Start Your Journey to Financial Freedom

Educate Yourself

Start by reading books, attending seminars, or taking courses on personal finance and wealth-building strategies.

Surround Yourself with Positive Influences

Join networking groups or online communities focused on financial growth and success.

Believe in Your Potential

Cultivate a strong belief in your ability to achieve financial freedom. Remember, your mindset is your biggest asset on this journey.

Ready to shift your mindset and take control of your financial future? Start by educating yourself, surrounding yourself with positive influences, and believing in the unlimited potential within you. Financial freedom is within your reach—you just have to believe it.

Join Robert Kiyosaki at the National Achievers Congress

Learn from the Master

Gain exclusive insights from "Rich Dad Poor Dad" author Robert Kiyosaki as he shares the mindset and strategies that built his financial empire.

Elite Networking

Connect with successful entrepreneurs and like-minded individuals committed to achieving financial independence.

Interactive Workshops

Participate in hands-on sessions designed to accelerate your journey to financial freedom with practical wealth-building techniques.

Transform your financial future at this exclusive event featuring world-class education, networking opportunities, and actionable strategies for building lasting wealth.Secure your spot today for the National Achievers Congress!

Take Action: Secure Your Financial Future

Economic uncertainty requires strategic action. Protect your wealth with these concrete steps.

Assess Your Current Situation

Create a complete inventory of assets and liabilities. Know exactly where you stand today.

Diversify Your Portfolio

Explore investments beyond traditional markets. Consider gold, real estate, and cryptocurrency.

Stay Economically Informed

Track global trends affecting currencies. Anticipate market shifts before they impact your wealth.

Implement Protection Strategies

Convert vulnerable assets to more stable forms. Build resilience against inflation and market volatility.

Ready to take action? Take our Free Financial Readiness Assessment to identify your next best moves.