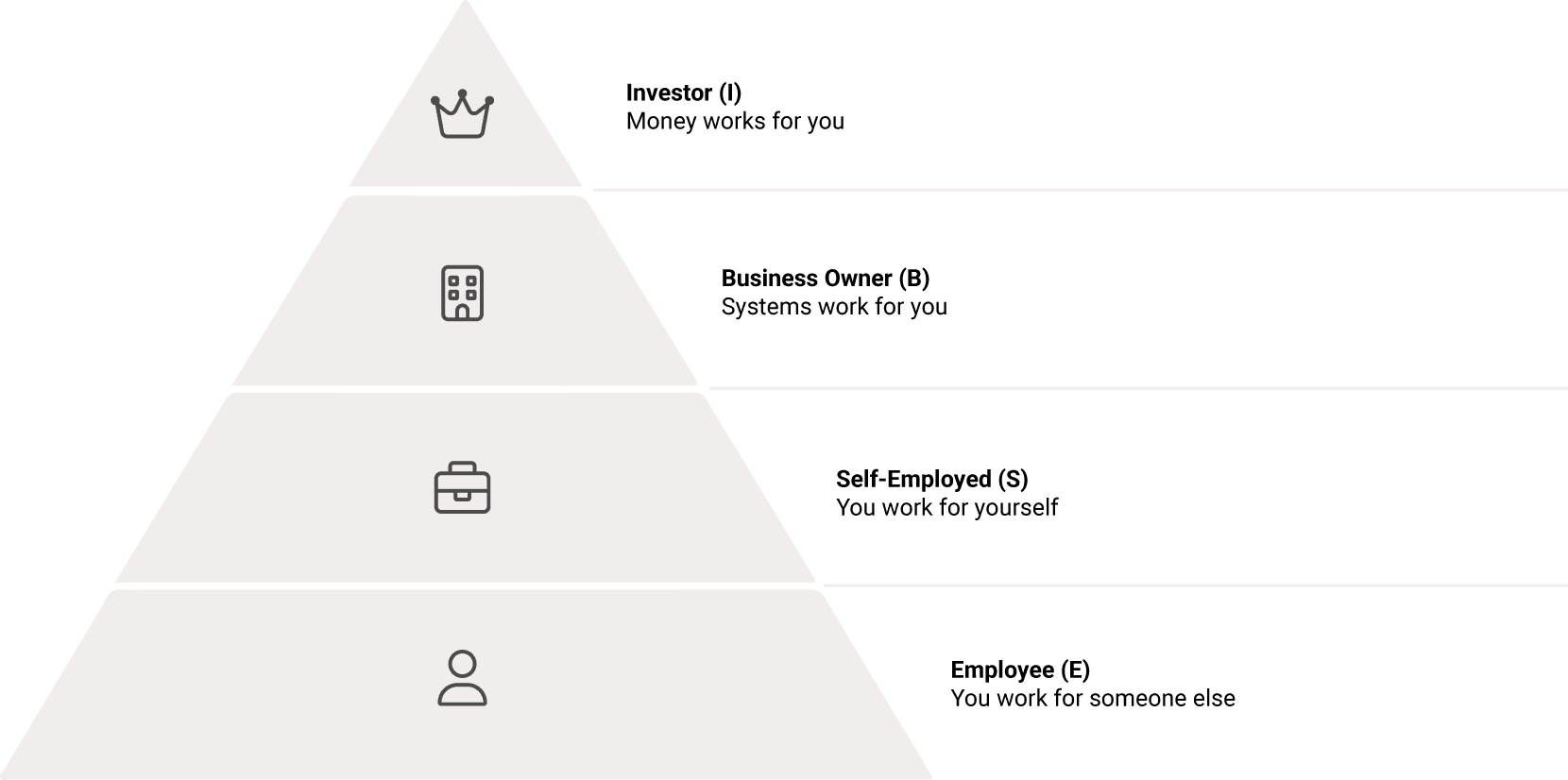

Understanding Robert Kiyosaki's Cashflow Quadrant

Robert Kiyosaki, the author of Rich Dad Poor Dad, introduced the concept of the Cashflow Quadrant to help individuals understand the different ways people earn income. The quadrant is divided into four sections, each representing a different approach to making money. Knowing where you stand can be the first step toward achieving financial freedom.

The Four Quadrants of Income

1. Employee (E)

Employees trade time for money, receiving a steady paycheck from an employer. While this quadrant provides security and stability, it also limits financial growth since earnings are tied directly to hours worked.

Depend on a salary

Employees rely on regular paychecks from their employer, creating a sense of security but also dependency.

Have job security but limited income potential

While employment offers stability, your earning potential is capped by your position, hours, and employer's budget.

Pay higher taxes

Employees typically face higher tax rates with fewer deductions compared to other quadrants.

2. Self-Employed (S)

Self-employed individuals work for themselves but still trade time for money. They have more control over their work but often face challenges scaling their income beyond their own efforts.

Own a small business or work as a freelancer

Self-employed individuals create their own jobs, running small businesses or offering specialized services directly to clients.

Control their own work schedule

They enjoy the freedom to set their own hours and choose their projects, but must maintain discipline to succeed.

Income depends on personal effort

Earnings are directly tied to the hours worked and personal productivity, creating a ceiling on potential income.

3. Business Owner (B)

Business owners build systems and hire people to work for them. They leverage other people's time and skills to create scalable wealth and financial freedom.

Own a business that operates independently

Business owners create organizations that can function without their constant presence.

Earn passive income through systems

They develop processes and teams that generate revenue even when they're not actively working.

Focus on scaling and delegation

Their primary role is strategic growth and empowering others to handle day-to-day operations.

4. Investor (I)

Investors make money work for them by putting capital into assets such as real estate, stocks, or businesses. They generate passive income and wealth without actively working for it.

Generate passive income

Investors earn money through dividends, interest, capital gains, and other returns on their investments.

Focus on building wealth through investments

They strategically allocate capital to assets that appreciate in value or produce ongoing income.

Achieve financial freedom by letting money grow over time

Through compound growth and smart asset allocation, investors create sustainable wealth that works for them.

Where Do You Belong?

Take a moment to assess which quadrant you currently belong to. Are you an employee seeking stability, a self-employed individual trading time for money, or an entrepreneur or investor building wealth?

| Employee | 25 |

| Self-Employed | 40 |

| Business Owner | 75 |

| Investor | 95 |

How to Move Towards Financial Freedom

Shift from Employee to Business Owner

Start by developing skills in entrepreneurship and learning how to create systems.

Transition from Self-Employed to Investor

Look into passive income opportunities like stocks, real estate, or other investments.

Invest in Financial Education

Read books, take courses, and learn from mentors who have successfully transitioned into wealth-building quadrants.

Conclusion

Understanding the Cashflow Quadrant is the key to breaking free from financial limitations and moving toward true wealth. By shifting your mindset and taking action, you can move from trading time for money to building lasting financial independence.

Are you currently working as an Employee, Self-Employed, Business Owner, or Investor? What steps are you taking to move toward financial freedom?

Moving between quadrants requires developing new skills, mindsets, and relationships. Start by educating yourself about your target quadrant and connecting with people who are already successful in that area.

While the Business Owner and Investor quadrants typically offer more financial freedom, the best quadrant depends on your personal goals, risk tolerance, and desired lifestyle. Many successful people operate in multiple quadrants simultaneously.

Experience a Breakthrough in Financial Thinking at National Achievers Congress

Break away from traditional financial mindsets and immerse yourself in next-level strategies at the National Achievers Congress. This high-impact event brings together global financial experts—including Robert Kiyosaki—to share proven systems for wealth creation, business growth, and personal freedom. Gain powerful insights, connect with purpose-driven entrepreneurs, and walk away with the tools and clarity to take decisive action toward your financial goals.

1000+

Attendees

Join a community of like-minded achievers

10+

Expert Speakers

Learn from global financial leaders

2

Transformative Days

Immersive wealth-building experience

Reserve your seat now and take the first step toward your financial breakthrough at National Achievers Congress.

Start with the Financial Readiness Test

Not sure where you stand financially? The Free Financial Readiness Assessment is designed to give you a clear snapshot of your current financial position. It identifies your strengths, uncovers hidden risks, and recommends your next best moves based on your unique profile. Whether you're just starting or looking to scale your wealth, this assessment provides the clarity and direction you need to take confident, strategic action toward financial independence. Take the Free Financial Readiness Assessment Test today and uncover your next move toward financial freedom.

Take Assessment

Complete the free online questionnaire

Receive Analysis

Get your personalized financial profile

Review Roadmap

Explore your recommended action steps

Take Action

Implement strategies for financial growth

Take the Free Financial Readiness Assessment Test today and uncover your next move toward financial freedom.