The Trap of the 9-5 Mindset

Most people grow up believing that success means getting a good education, securing a stable job, and working hard until retirement. This traditional approach conditions individuals to trade time for money, limiting their financial growth.

The Rich Dad mentality, popularized by Robert Kiyosaki, challenges this mindset and encourages people to think like investors and entrepreneurs.

The Key Differences: Employee vs. Investor Mindset

Trading Time for Money vs. Making Money Work for You

Employees exchange hours for wages, making their income dependent on how much they work.

Security vs. Freedom

Employees seek job security, health benefits, and retirement plans.

Linear vs. Exponential Income Growth

Salaries increase gradually and are often capped.

Making Money Work for You

Leverage Systems

Investors and business owners leverage systems to grow their wealth.

Utilize Assets

Use assets to generate passive income and increase wealth.

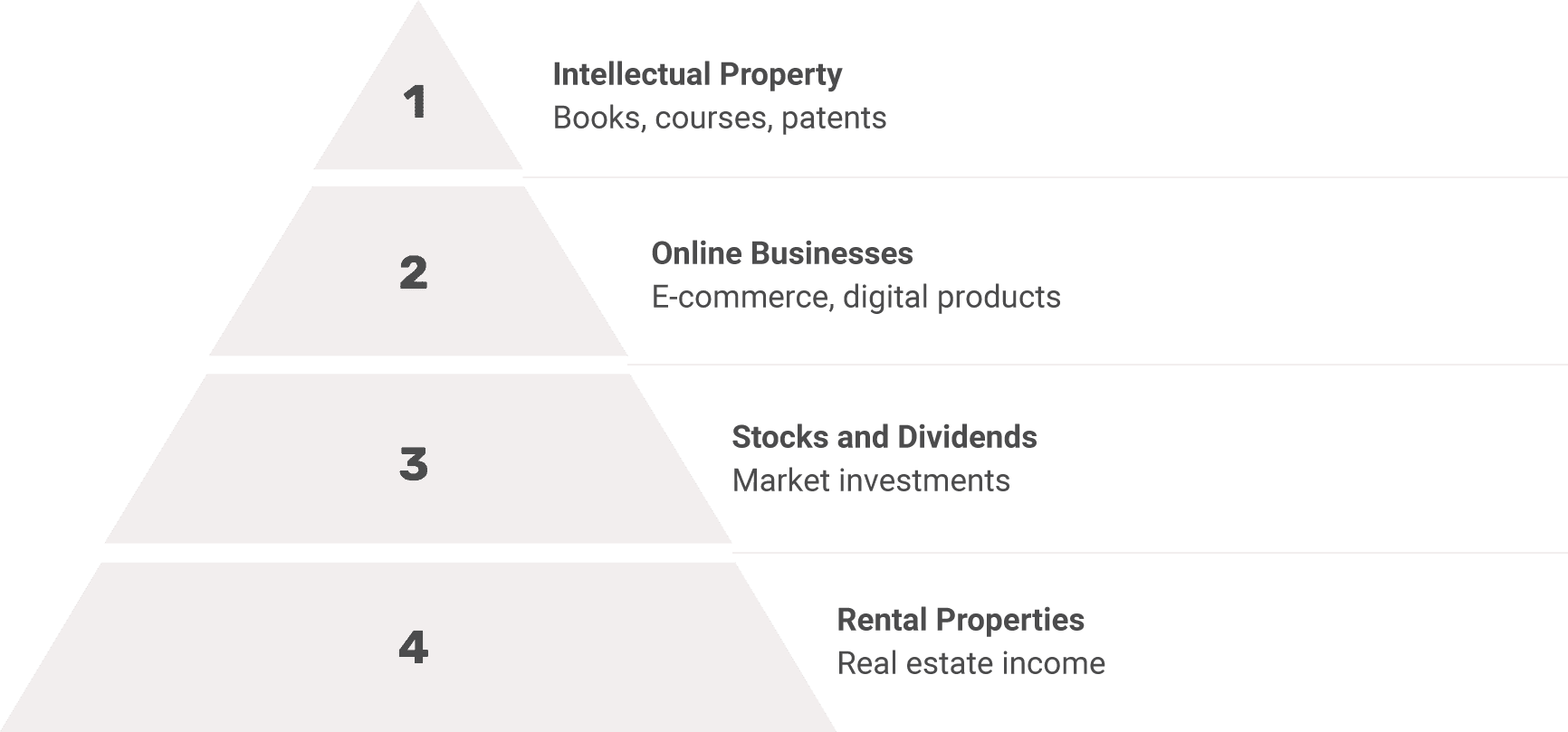

Passive Income

Focus on creating streams of income that don't require constant time investment.

Freedom Over Security

Financial Independence

Wealth builders focus on achieving financial independence.

Living on Your Terms

The investor mindset allows you to live life on your own terms.

Unlimited Potential

Break free from the limitations of traditional employment.

Exponential Income Growth

Investments, businesses, and assets can grow exponentially, creating unlimited earning potential compared to the gradual and often capped increase of salaries.

How to Break Free from the 9-5 Cycle

Shift Your Mindset

Recognize that wealth is built by creating assets, not by relying solely on a paycheck.

Develop Multiple Streams of Income

Start exploring side hustles, passive income opportunities, and investments.

Invest in Assets, Not Liabilities

Focus on assets that generate income, while avoiding liabilities that drain it.

Take Calculated Risks

Step outside your comfort zone to break free from the 9-5 mentality.

Shift Your Mindset

Read Books

Expand your knowledge through financial literature.

Apply Knowledge

Put what you learn into practice to reinforce your new mindset.

Take Courses

Invest in your education with targeted learning.

Network

Surround yourself with successful entrepreneurs and investors.

Develop Multiple Streams of Income

Primary Job

Start with your main source of income.

Side Hustle

Explore additional income opportunities.

Passive Income

Create income streams that work for you.

Investments

Grow your wealth through strategic investing.

Invest in Assets, Not Liabilities

Take Calculated Risks

Start Small

Begin with low-risk investments or side projects.

Gain Experience

Learn from your successes and failures.

Increase Investment

Gradually allocate more resources to promising ventures.

Transition

Gradually transition away from reliance on a 9-5 job.

Test Your Readiness to Break Free

Before you can escape the 9-5 cycle, you need to assess your financial foundation and mindset alignment.

Identify Financial Gaps

Uncover the limiting beliefs and knowledge gaps keeping you trapped in the employee mindset.

Discover Your Strengths

Recognize which Rich Dad principles you're already implementing and areas needing improvement.

Get a Personalized Roadmap

Receive actionable steps to transition from trading time for money to building wealth through assets.

Learn Directly from Robert Kiyosaki

Ready to accelerate your journey toward financial independence? Join Robert Kiyosaki live at the National Achievers Congress, where you'll gain practical strategies to shift your mindset, create assets, and escape the 9-5 grind for good.

Expert Knowledge

Learn from world-class wealth and business experts who've already achieved financial freedom

Valuable Connections

Network with like-minded entrepreneurs and investors building their own wealth empires

Practical Implementation

Experience workshops designed to help you implement the Rich Dad philosophy in real life

Think like a Rich Dad!

Freedom Is a Choice—Make It Yours

Financial Education

The difference between the rich dad mentality and the traditional 9-5 mindset comes down to continuous learning and application of financial knowledge.

Calculated Risk-Taking

Embracing smart risks is essential for breaking free from the conventional career path and achieving financial freedom.

Strategic Investing

By shifting your approach to money and focusing on creating assets, you can create financial freedom and lasting wealth.

Are you ready to break free from the 9-5 cycle?