Imagine this: you're stuck in a paycheck-to-paycheck cycle, saving almost nothing—and it's not because you earn too little, but because you're unknowingly running a habit loop that eats your paycheck before you even see it.

The Power of Habit Behind Your Finances

James Clear's Atomic Habits reveals a revolutionary truth: small, consistent changes create massive long-term results.

Apply this to your finances—saving just $3/day or $20/week—and you'll build unstoppable momentum.

A 2023 U.S. News study showed that people who created weekly savings habits were 40% more likely to achieve six-figure net worths by age 30.

Real-world example: Sarah, a 28-year-old marketing coordinator, automated just $10/week into a high-yield savings account. Two years later, she had over $1,000 saved for emergencies, without noticing the difference in her lifestyle.

The Controversy: Is Frugality Overrated?

One side

Says cut the coffee, ditch takeouts, and stop spending.

The other side

Argues that extreme frugality is joyless and unrealistic.

Here's the real breakthrough: behavioral change beats budgeting. It's not about deprivation—it's about sustainable, identity-based habits. Mindful spending and intentional saving work better than temporary budget "detoxes."

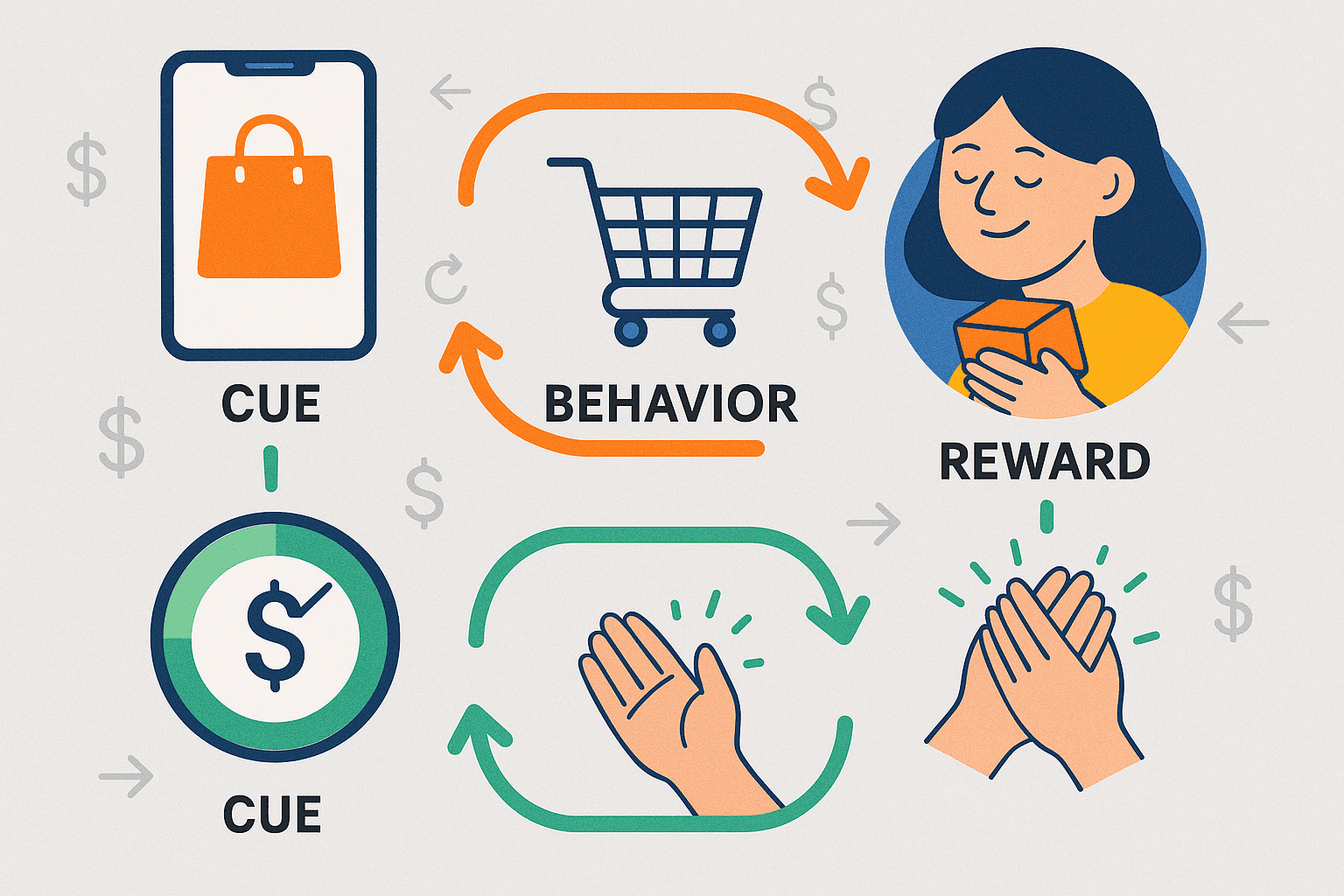

Habits Are Financial Blueprints

You can flip the loop: cue = checking your savings tracker; reward = small celebration for hitting a goal. Trigger, behavior, reward. That's the formula.

The 1% Rule That Changed Everything

Start Small

Mark started saving just 1% of his monthly income

Gradual Increase

Increased it by 1% each month

Significant Results

Within 10 months, he was saving 10%, or nearly $500/month

Without noticing much sacrifice, he cleared debt and started investing—by habit, not pressure.

Small Habits, Big Gains

$600

Save $50/month

$208

Skip one $4 latte/week

$5,200

Automate $100/week

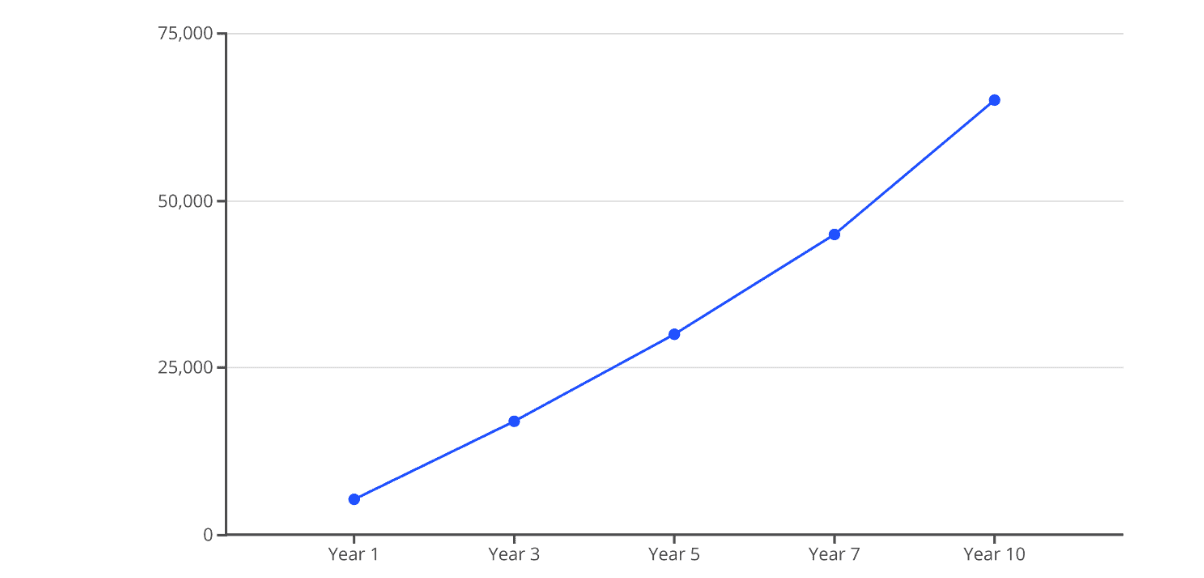

With a 5% annual return, consistent $100 weekly deposits can grow to over $65,000 in 10 years—without massive effort.

That Challenge Common Financial Beliefs

Ditch rigid budgets. Build flexible systems.

Automate savings and let discipline run in the background.

Start ridiculously small.

Even saving $10 a week rewires your brain for success.

Stack your habits:

Review your spending right after morning coffee. Transfer $20 after your gym session.

Use visual progress charts:

Tools like Mint, YNAB, or a simple spreadsheet build momentum.

Reframe identity:

Don't say "I'm trying to save." Say "I'm someone who saves."

Alternative Solutions You've Never Tried

Round-up investing apps

Automatically invest your spare change from daily purchases.

Gamify your savings

Use apps that reward consistency and milestones.

Accountability partners

Share monthly financial goals with a friend to boost follow-through.

Temptation bundling

Only listen to your favorite podcast while checking your portfolio.

These tools replace guilt-based frugality with rewarding financial behavior—and they actually stick.

Your Move Toward Financial Independence

Your money problems aren't just about income—they're about automatic behaviors. Once you take control of your financial habits, you start compounding momentum in your favor.

Automate Savings

Start now: automate just $25/week into savings. Watch what happens in 3 months.

Learn Habits Faster

Want a shortcut to learning the habit system? Check out the SR Book Insights YouTube Channel. Their episode on Atomic Habits condenses the most life-changing ideas into a 10-minute masterclass. Watch it here and subscribe for more powerful book breakdowns that change the way you live and earn.