The Truth About Debt: Not All Debt is Created Equal

Good Debt: The Wealth-Building Tool

Good debt is debt that works for you. It's an investment that has the potential to generate more wealth in the future than it costs you today. Here are some common examples of good debt:

Bad Debt: The Wealth-Killer

Bad debt is any debt that holds you back financially and doesn't provide an opportunity for future wealth. The danger of bad debt is that it often leads to cycles of borrowing and repaying that never truly ends. Here are common examples of bad debt:

How the Wealthy Use Good Debt to Build Wealth

1

Investing in Real Estate

Wealthy individuals often use mortgages to purchase rental properties. These properties generate passive income through rents, which can cover the mortgage payments and potentially provide long-term capital appreciation.

2

Leveraging Business Loans

Many successful entrepreneurs take out loans to scale their businesses, hire employees, or develop new products. These loans are paid back with the increased revenue the business generates, leading to greater profits.

3

Tax Benefits

Certain forms of debt come with tax advantages, especially when it comes to business loans and mortgages. The interest paid on these debts can be deductible, allowing you to reduce your taxable income.

How to Use Debt Strategically: Actionable Tips

Take Control of Your Debt

Before you can use debt to your advantage, you need to understand what types of debt you have. If you're buried in bad debt, focus on eliminating it first. Pay off high-interest credit cards and loans as quickly as possible to free up cash flow for investing.

Invest in Income-Generating Assets

Use good debt to purchase assets that will generate income over time, such as real estate, stocks, or a business. Be sure that the potential return on investment outweighs the cost of the debt.

Be Mindful of Interest Rates

The lower the interest rate, the easier it is to manage debt. Always compare options and choose the debt that offers the best terms.

Don't Over-leverage

While using debt to leverage wealth is powerful, it's important not to over-leverage. Too much debt can put you at risk if your investments don't perform as expected. Always ensure that your debt-to-equity ratio stays healthy.

Seek Professional Advice

Consult with financial experts or advisors who can help you build a strategic plan for using debt to build wealth. Robert Kiyosaki himself often advises individuals to find mentors who have mastered the art of using good debt.

The Power of Good Debt: Real-World Examples

Mortgages

Buying a home is often a path to building wealth. Your property can appreciate, providing an asset that grows in value over time.

Business Loans

Wisely used loans for business growth can yield significant returns. They enable investment in assets that help your business expand and thrive.

Investment Debt

Borrowing to invest in assets like stocks or real estate can boost returns, especially if the investment outperforms the debt's interest rate.

The Dangers of Bad Debt: What to Avoid

Credit Card Debt

With high interest rates, credit card debt can quickly spiral out of control, taking away your ability to save or invest. It's easy to fall into a cycle of borrowing to pay for things you don't need, and before you know it, the debt becomes unmanageable.

High-Interest Loans

Similar to credit card debt, loans with high interest rates (such as payday loans) can make it difficult to pay off the principal, leaving you stuck in a financial rut.

Auto Loans

While cars are essential for many people, they often depreciate quickly in value. An auto loan can become bad debt if you're financing a vehicle that loses its value faster than you're paying it off.

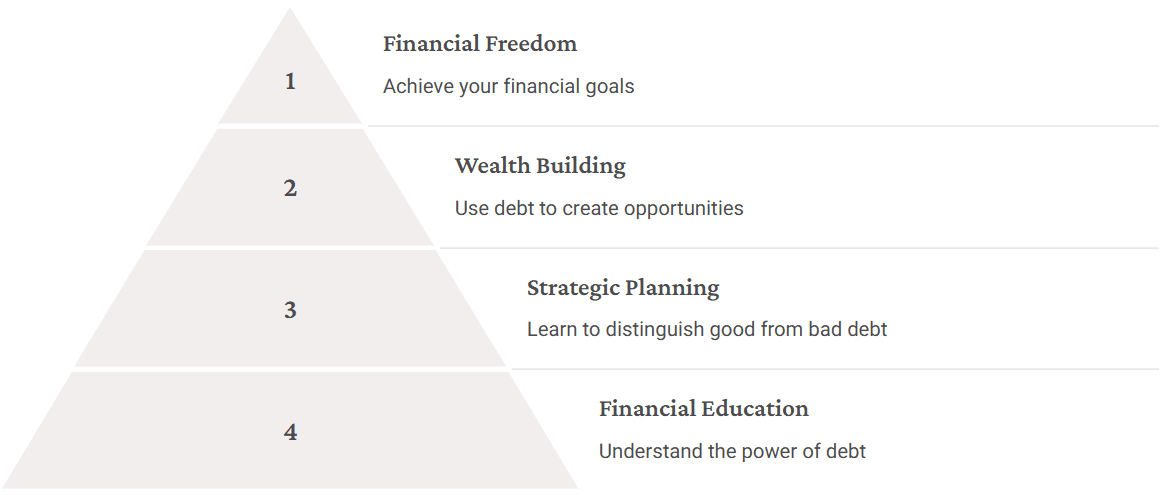

Use Debt to Your Advantage

1

Debt as a Tool

Debt doesn't have to be a four-letter word. When used strategically, debt can be an incredible tool for building wealth, growing your business, and increasing your assets.

2

Distinguish Good from Bad

The key is to distinguish between good debt and bad debt, and use the former to create opportunities for your financial future.

3

Assess Your Situation

Take a moment to assess your current debt situation. Are you using debt to build your wealth, or are you falling into the trap of bad debt?

Are you ready to start playing the game of debt the right way?

If you're ready to level up your financial game, start learning how to use debt as a tool to accelerate your wealth-building journey. Your future self will thank you for it!

Join Us for Financial

Mastery!

Ready to deepen your financial knowledge and learn directly from the best? The National Achievers Congress Singapore is your chance to gain practical strategies from global experts like Robert Kiyosaki.

Dates & Location

August 23–24, 2025

Marina Bay Sands, Singapore

Global Experts

Hear from Robert Kiyosaki and other world-renowned speakers.

Connect & Grow

Network with a powerful community of entrepreneurs and investors.

Join us at the National Achievers Congress Singapore at Marina Bay Sands — with the option to attend face to face or via Hybrid Live Streaming Online on Zoom. Wherever you are, register and attend in the way that fits your comfort and schedule.

Take the FREE Financial Readiness Assessment Test

Before mastering strategic debt, understand your current financial standing. Our FREE Financial Readiness Assessment Test provides valuable insights into your financial health, uncovers knowledge gaps, and offers a customized roadmap. In minutes, gain clarity, identify growth opportunities, and build a stronger foundation for smarter wealth-building decisions. It's your first step toward transforming debt into financial freedom.

Master Debt, Master Wealth

Debt doesn’t have to be your enemy — it can be your most powerful ally. By understanding the difference between good debt and bad debt, and learning how to use debt strategically, you can transform your financial future. Start today: educate yourself, plan wisely, and take action to use debt as a tool for lasting wealth. Your journey toward financial freedom begins now!