The Illusion of Passive Income

Common Misconception

Passive income is often portrayed as making money while you sleep, requiring zero effort. This sounds too good to be true, and often it is.

Kiyosaki's Warning

Robert Kiyosaki warns about "false" passive income streams that appear easy but require significant time, effort, or capital to set up and maintain.

Reality Check

Building true wealth takes time and the right kind of assets. Even legitimate passive income sources often require strategic investment and upfront work.

Real Estate: Kiyosaki's Cornerstone Strategy

Income-Generating Assets

Real estate is a cornerstone of Kiyosaki's financial strategy. Whether you're buying rental properties or investing in commercial real estate, the idea is to acquire income-generating assets.

Steady Cash Flow

While owning property requires initial capital and management, it has the potential to produce steady cash flow through rental payments.

Long-Term Appreciation

Real estate typically appreciates over time, offering not just passive income but also long-term wealth accumulation.

Royalties and Licensing: Creative Passive Income

1

Create

Develop a creative or intellectual product like a book, music, or patented invention.

2

License

License your creation for others to use or sell.

3

Earn

Earn royalties every time your product is sold or used.

4

Repeat

Continue to earn with minimal involvement long after the initial creation.

Royalties and Licensing: Creative Passive Income

Create

Develop a creative or intellectual product like a book, music, or patented invention.

Repeat

Continue to earn with minimal involvement long after the initial creation.

License

License your creation for others to use or sell.

Earn

Earn royalties every time your product is sold or used.

Dividends from Stocks: Steady Income Stream

01

Focus on Dividend-Paying Stocks

Kiyosaki advises investors to focus not only on capital gains from stocks but also on dividend-paying stocks.

02

Regular Payments

Dividends are regular payments made by companies to their shareholders, often quarterly.

03

Steady and Growing Income

If you invest in stable, reliable companies that pay dividends, this can be a steady and growing income stream.

04

Choose Wisely

The key is choosing companies that have a history of paying and increasing dividends, which ensures consistent cash flow without ongoing effort.

Peer-to-Peer Lending: Alternative Passive Income

Lend

Lend money to individuals or small businesses through peer-to-peer platforms.

Earn Interest

Receive interest payments on your loans.

Reinvest

Reinvest earnings or withdraw as passive income.

Diversify

Spread risk across multiple loans for stability.

The Truth About Other "Passive" Income Streams

1

Affiliate Marketing

Requires building an audience, creating content, and constant marketing efforts to keep income coming in.

2

Online Courses and E-books

Creating high-quality content takes significant time and energy. Ongoing marketing is needed to maintain income.

3

Cryptocurrency

Volatile market requiring constant attention. Substantial risks involved, especially with newer cryptocurrencies.

How to Build True Passive Income

Start Early

Begin investing in income-generating assets as early as possible to allow your money more time to grow.

Know Your Risk Tolerance

Understand the risks associated with your investments and choose ones that align with your risk tolerance and long-term goals.

Automate Where Possible

Set up automatic processes like dividend reinvestment plans (DRIPs) or use property management services to maximize returns without continuous effort.

Educate Yourself

Continually learn about new opportunities, market trends, and strategies for optimizing your income streams.

Evaluating Your Passive Income Strategy

Evaluate your current income streams. Are they truly passive or do they require constant effort and attention? Focus on long-term, reliable sources like real estate, dividends, and royalties for true financial freedom.

If you find yourself constantly working to maintain your "passive" income streams, it might be time to reassess your strategy. Look for opportunities that require less ongoing involvement once established.

Ready to Start Building Your Passive Income?

1

Assess Your Current Strategy

Take a close look at your existing income streams and investments. Are they aligned with Kiyosaki's advice for true passive income?

2

Identify Areas for Improvement

Determine which of your current strategies may need adjustment or replacement with more passive options.

3

Create an Action Plan

Develop a step-by-step plan to transition towards more reliable passive income sources, such as real estate or dividend-paying stocks.

4

Take Action

Start implementing your plan today. Remember, the sooner you begin, the more time your passive income has to grow.

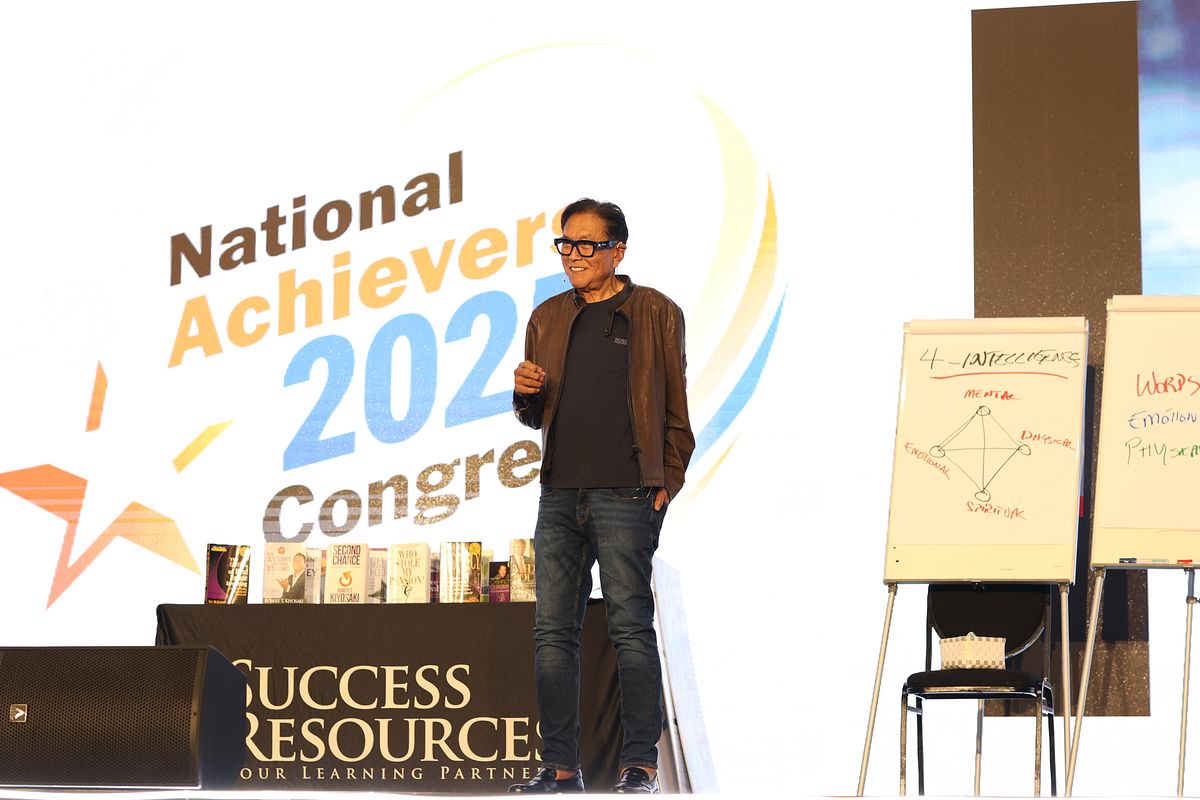

Your Gateway to Wealth: National Achievers Congress Singapore

Join the National Achievers Congress Singapore on August 23–24, 2025, to learn directly from world-renowned experts like Robert Kiyosaki. This is your chance to gain powerful strategies and connect with a global network of entrepreneurs and investors.

Where

Marina Bay Sands

When

August 23–24, 2025

Access

In Person or Hybrid Live Stream on Zoom

Whether in person or online, you'll hear real-life success stories and unlock the potential for true wealth creation, no matter where you are in the world.

Find Out If You’re Ready for Wealth

Get Your FREE Financial Readiness Assessment.

Assess Your Standing

A quick, insightful tool to evaluate your current financial situation, identifying strengths and areas needing attention.

Gain Tailored Insights

Receive personalized recommendations to enhance your money management, investing habits, and wealth-building strategies.

Launch Your Future

More than a test, it's your personal starting point to take control and accelerate your journey toward financial freedom.

Turn Passive Income Myths into Financial Reality

The road to true passive income isn’t about chasing the easiest trend — it’s about building solid, income-generating assets that work for you over time. By following Kiyosaki’s proven strategies, you can move beyond the illusion of “effortless” money and start creating sustainable wealth that lasts. Financial freedom isn’t a matter of luck — it’s the result of intentional choices, consistent action, and the right knowledge to guide you.