When people think about becoming a millionaire, the usual images come to mind: long hours at the office, chasing promotions, taking risky investments, cutting out every "latte" just to save a few bucks. But here's the uncomfortable truth: that belief is holding people back. Wealth isn't really about how much you earn—it's about how much you keep, grow, and protect.

The Hidden Power of Automation

Imagine a system where money moves silently in the background, like clockwork. You wake up, live your day, and behind the scenes, your bank account is funding your future—automatically. Savings build up without you manually moving money around. Investments grow with compound interest, even when you're not watching. Your home payments add to your net worth, rather than disappearing into rent.

This is not about budgeting. David Bach argues that budgets don't work because they rely on willpower—and willpower runs out. The secret? Automation. A system that works for you, not against you.

Pay Yourself First Automatically

Save Before You Spend

Instead of saving "whatever's left," Bach insists you save before you spend. By setting up automatic transfers from your paycheck into savings or retirement accounts, you guarantee your future wealth comes first.

Start Small, Win Big

If you wait until the end of the month to save, there's usually nothing left. But if you take 10% (or even 5%) off the top automatically, you don't even feel the loss—and over years, it turns into hundreds of thousands.

The Latte Factor

This is one of Bach's most famous ideas. It's not literally about coffee—it's about the small, unconscious daily expenses that eat away at your wealth. A $5 daily coffee may seem harmless. But over 30 years, invested with compound growth, it could add up to $100,000 or more.

The point isn't to never buy coffee again. The point is to recognize how small changes, automated over time, create big results.

Daily Coffee

Seems harmless in the moment

30-Year Value

With compound growth invested

Automated Homeownership

Forced Savings Plan

Bach is a strong advocate for buying a home—not because it's trendy, but because it acts as a forced savings plan. Every mortgage payment you make builds equity, which grows your net worth.

Build Your Wealth, Not Your Landlord's

Renting builds your landlord's wealth, not yours. By automating mortgage payments, you ensure you're investing in your future every single month.

The Automatic Money Flow System

This is where it all comes together. Bach suggests creating a system where everything happens automatically—no willpower required. Once this system is set up, you don't need discipline. The machine runs on its own.

Your Paycheck

Automatically divides into different accounts

Retirement Contributions

Deducted before you see the money

Bills

Paid automatically to avoid late fees

Savings

Tucked away before you have a chance to spend

Focus on Net Worth, Not Just Income

The Income Illusion

Many people confuse high income with wealth. But true wealth is measured in net worth—what you own minus what you owe.

The Real Wealth Formula

A person making $50,000 with no debt, steady savings, and automated investments can be wealthier than someone earning $200,000 but spending every dollar.

Bach's message is clear: You don't have to earn more—you just have to keep more, automatically.

The Surprising Truth About Becoming Rich

What You Don't Need

What You Don't Need

A system. And once that system is in place, the path to becoming an Automatic Millionaire is almost boring. There's no drama, just quiet, consistent growth.

Wealth doesn't need to be complicated.

Why This Matters for You

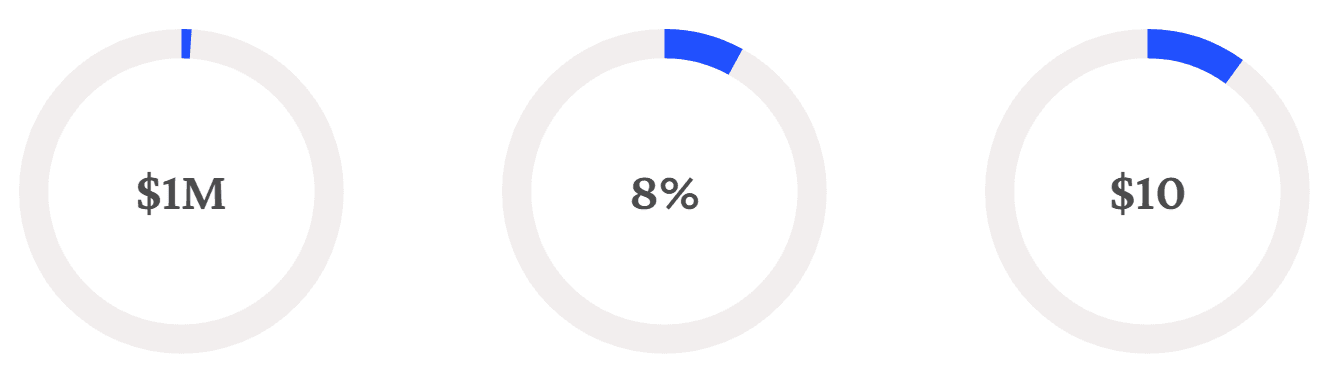

40-Year Result

From just $10 a day at 8% return

Average Return

Historical market performance

Daily Investment

Small amount, massive impact

If you set aside just $10 a day, automatically, at an average 8% return—you'd have nearly $1 million in 40 years. If you start earlier, even smaller amounts turn into huge results thanks to compound interest. If you own a home and keep investing in it, your net worth multiplies over time almost without trying.

The real danger isn't earning too little—it's waiting too long to start.

The Millionaire Secret Hidden in Plain Sight

The Wealth Shift

Wealth isn't built in giant leaps—it's built in invisible, automatic steps that compound over years. The wealthy don't rely on willpower; they rely on systems.

The Simple Truth

The strategies that turn ordinary people into millionaires aren't hidden in secret codes or Wall Street jargon. They're simple, repeatable, and shockingly accessible.

David Bach's brilliance isn't in showing you something complicated—it's in showing you that the easiest path was right in front of you all along. Becoming a millionaire is not about luck, it's about a system so simple, most people overlook it. It's the difference between pushing a boulder uphill every month… and setting it rolling downhill, gathering speed on its own.