Despite working hard, most people find themselves trapped in a cycle of earning just enough to cover expenses—never truly breaking free. The truth is, traditional financial advice is outdated, and the wealthy follow a completely different set of rules.

The Harsh Truth About Financial Struggles

78%

Living Paycheck to Paycheck

Americans trapped in a cycle of earning just enough to cover expenses

60%

Can't Afford $1,000 Emergency

Americans vulnerable to economic downturns and unexpected financial shocks

Despite working hard, most people find themselves trapped in a cycle of earning just enough to cover expenses—never truly breaking free. The truth is, traditional financial advice is outdated, and the wealthy follow a completely different set of rules.

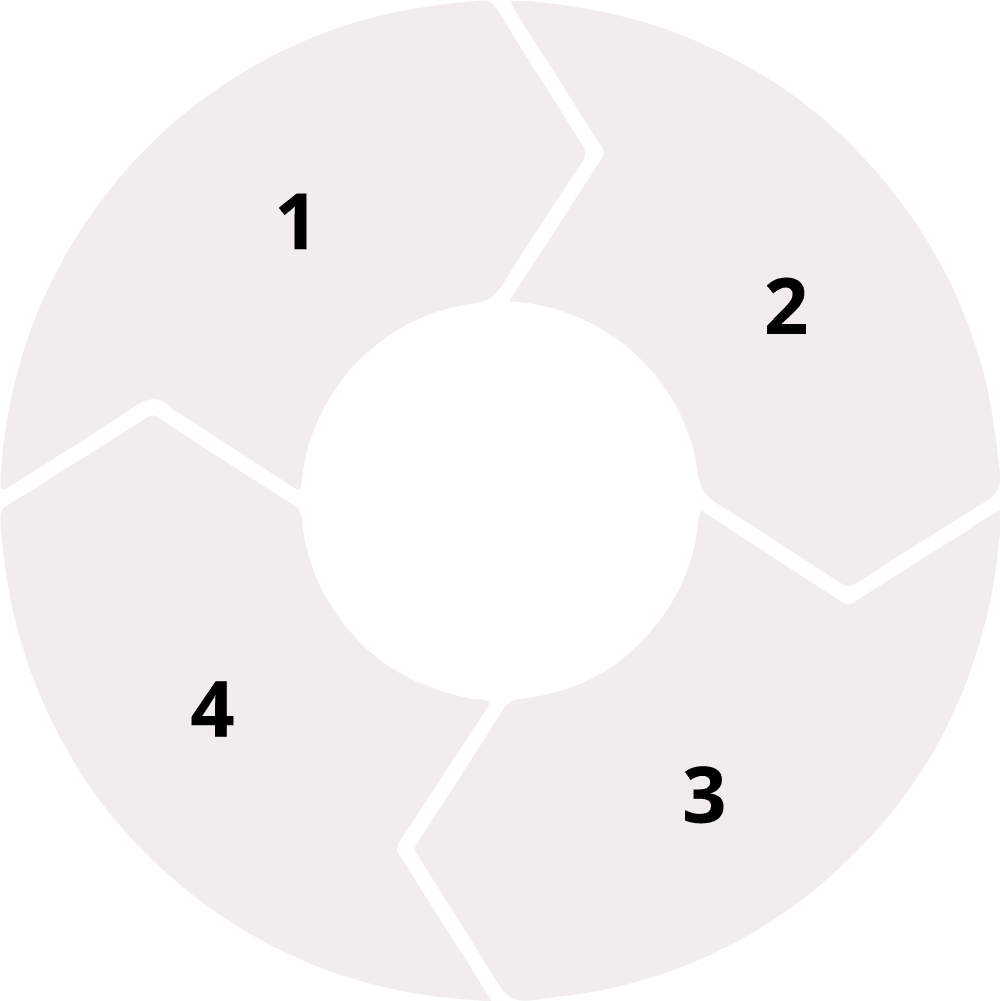

Why Most People Struggle Financially

1

Go to school, get good grades.

2

Secure a stable job with a steady paycheck.

3

Save money and invest in a 401(k).

But this formula often leads to financial stagnation, not freedom. The system is designed to keep you working for money rather than making money work for you.

The Wealthy Think Differently: The Cashflow Quadrant

E - Employee

Works for a paycheck

(most people fall here)

I - Investor

Money works for them

(stocks, real estate, businesses)

S - Self-employed

Trades time for money

(doctors, freelancers, consultants)

B - Business Owner

Owns a system that generates income

(franchises, companies)

Robert Kiyosaki, author of Rich Dad Poor Dad, introduced the Cashflow Quadrant, which divides income earners into four categories. The key to escaping the rat race is shifting from the E & S quadrants to the B & I quadrants, where passive income fuels financial freedom.

Real-World Success Stories: From Paycheck to Prosperity

Abang Abu: The Cashflow Game Changer

Abang Abu, a financial literacy expert, transformed his life using Robert Kiyosaki's Cashflow Board Game. Once struggling to manage finances, he learned how to leverage assets and investments, ultimately gaining financial independence. Today, he educates thousands on achieving similar success.

The Rise of Entrepreneurs

Take Elon Musk, who reinvested every dollar from his first startup into building Tesla and SpaceX. His long-term vision and investment mindset propelled him into billionaire status, while most people stay stuck chasing short-term stability.

Actionable Strategies to Escape the Rat Race

Shift from Employee to Investor Mindset

Instead of saving money in low-yield accounts, invest in assets that generate passive income (real estate, stocks, online businesses).

Master the Art of Cashflow

Track your income and expenses. Focus on increasing assets that put money in your pocket rather than liabilities that drain your finances.

Start a Side Hustle or Business

Leverage the digital economy by starting an online business, investing in rental properties, or becoming an angel investor.

Get Financial Education

Read Financial Books

Start with Rich Dad Poor Dad and other financial literacy classics.

Attend Workshops

Participate in financial workshops to gain practical knowledge.

Network with Investors

Connect with successful investors to learn from their experiences.

Play the Cashflow Board Game

Simulate Real-World Decisions

The Cashflow Board Game allows you to practice financial decision-making in a risk-free environment.

Develop Strategic Thinking

Learn to think like an investor and make strategic financial choices.

Build Wealth-Building Skills

Gain practical skills for managing assets, liabilities, and cash flow.

Challenge Your Financial Beliefs & Take Action

1

Question Traditional Advice

Challenge what you've been taught about money and success.

2

Rethink Financial Habits

Analyze your current financial habits and identify areas for improvement.

3

Focus on Passive Income

Shift your focus from working harder to creating streams of passive income.

4

Take Consistent Action

Implement new strategies consistently to see long-term results.

Are you ready to start your Cashflow Revolution?

1

Join our financial education workshop

2

Take the first step toward financial independence

3

Learn strategies to build lasting wealth

Click the link to learn more! Cashflow Revolution 2025

Are You Truly Financially Ready for Freedom?

Understanding money is just the beginning. The real question is—are you financially prepared for the future?

Identify Knowledge Gaps

Uncover areas where you need to improve your financial understanding.

Discover Key Strategies

Learn strategies to accelerate your wealth-building journey.

Get a Personalized Roadmap

Receive a tailored plan for achieving financial success.

Take the FREE Financial Assessment Now!

1

Answer a series of targeted questions about your financial situation

2

Receive an instant analysis of your financial readiness

3

Get personalized recommendations for improvement

Take our Free Cashflow Readiness Assessment and uncover where you stand. Take the Assessment!

Your Journey to Financial Freedom Starts Here

1

Take the Assessment

Understand your current financial position

2

Join Cashflow Revolution

Learn from experts and like-minded individuals

3

Implement Strategies

Apply what you've learned to your financial life

4

Achieve Financial Freedom

Break free from the rat race and live life on your terms

Don't wait another day to take control of your financial future. Start your journey to financial freedom now!