The Importance of Smart Investments

Traditional Approach

Relying solely on your job income won't create long-term wealth. The traditional notion of working hard, earning a paycheck, and spending it all on bills and expenses feels like a never-ending cycle.

Smart Investments

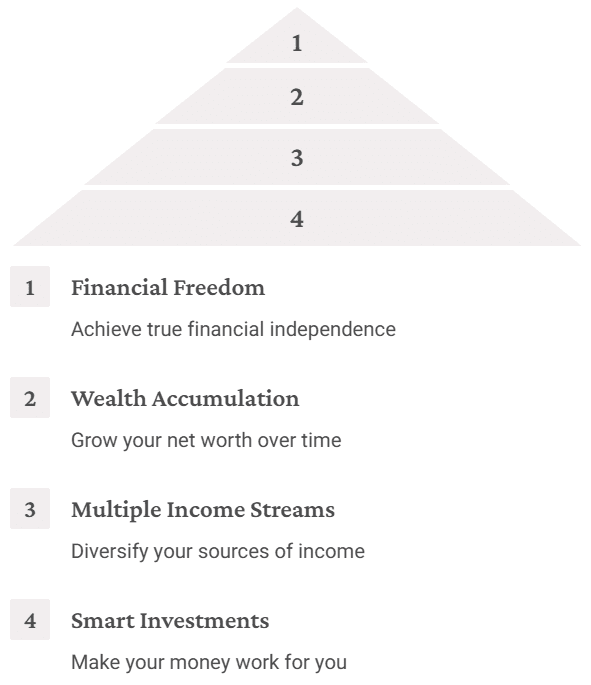

Making money work for you begins with understanding the power of smart investments. By investing in assets that appreciate over time, such as real estate, stocks, and businesses, you create multiple income streams that continue to grow, even when you're not actively working.

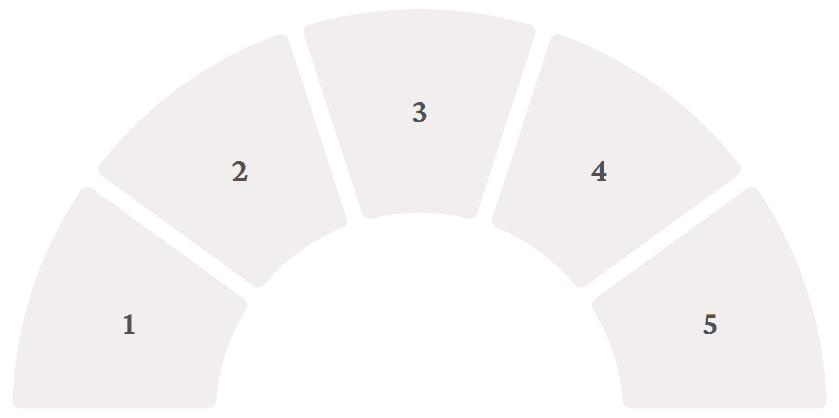

Investing in Real Estate: A Time-Tested Strategy

1

Property Appreciation

Properties tend to appreciate over time, meaning your investment grows as demand for housing increases.

2

Passive Income

Rental income provides a passive income stream, allowing you to earn while you sleep.

3

Building Equity

Many savvy investors buy properties, rent them out, and use the monthly rent payments to cover mortgage costs. As the value of the property increases, the investor builds equity and profits from rental income.

Stocks: The Power of Compound Growth

1

Long-Term Gains

Stocks offer incredible opportunities to grow wealth, especially when leveraged for long-term gains.

2

Compound Growth

Investing in companies that are growing or paying dividends allows you to capitalize on the compounding nature of the stock market.

3

Exponential Growth

Over time, even modest investments can grow exponentially.

4

Warren Buffett Example

Consider the example of Warren Buffett, one of the world's richest individuals, who built his fortune through stock investments. By investing early and letting compounding do its work, Buffett has amassed a fortune that continues to grow—even without him having to actively work for it.

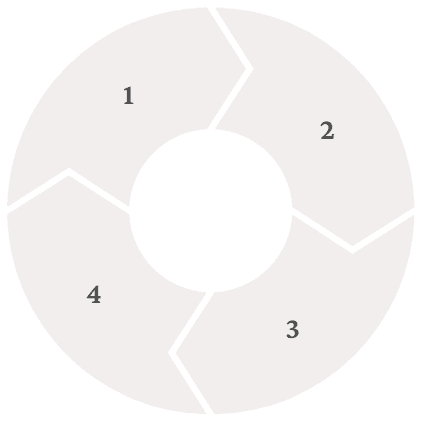

Diversify Your Portfolio

1

Real Estate

Invest in properties for appreciation and rental income.

2

Stocks

Capitalize on company growth and dividends.

3

Peer-to-Peer Lending

Earn interest by lending directly to borrowers.

4

Cryptocurrency

Explore digital assets for potential high returns.

5

Small Businesses

Invest in local or online businesses for growth potential.

The Power of Financial Education

Prioritize Learning

Before diving into investments, prioritize financial education. Understanding the basics of budgeting, saving, and investing is crucial.

Diverse Learning Sources

Financial education doesn't have to come from a formal degree—it can be learned through books, podcasts, online courses, and even mentorship from experienced investors.

Continuous Education

Many successful individuals attribute their wealth-building success to constantly educating themselves and staying up-to-date with financial trends.

Actionable Steps to Get Started

Educate Yourself

Start by reading books or taking courses on investing and personal finance. Look for trusted sources like Rich Dad Poor Dad by Robert Kiyosaki or The Intelligent Investor by Benjamin Graham.

Start Small

Begin by investing in low-cost index funds or real estate crowdfunding platforms. This minimizes risk while allowing you to learn the ropes.

Create a Financial Plan

Set clear goals for your investments, and build a strategy that aligns with your long-term financial objectives.

Reinvest Earnings

As your investments generate income, reinvest the profits to compound your wealth even faster.

Consult Experts

Don't be afraid to reach out to financial advisors or mentors who can guide you as you start building your wealth.

Real-World Example: Robert Kiyosaki's Journey

1

Financial Education

Robert Kiyosaki emphasizes that financial education was his gateway to wealth.

2

Real Estate Investments

He famously made his first significant wealth through smart investments in real estate.

3

Sharing Knowledge

Kiyosaki authored "Rich Dad Poor Dad" to share his insights on financial freedom.

4

Proof of Concept

His story shows that you don't need a high-paying job to create financial freedom—what you need is the right knowledge and the courage to invest.

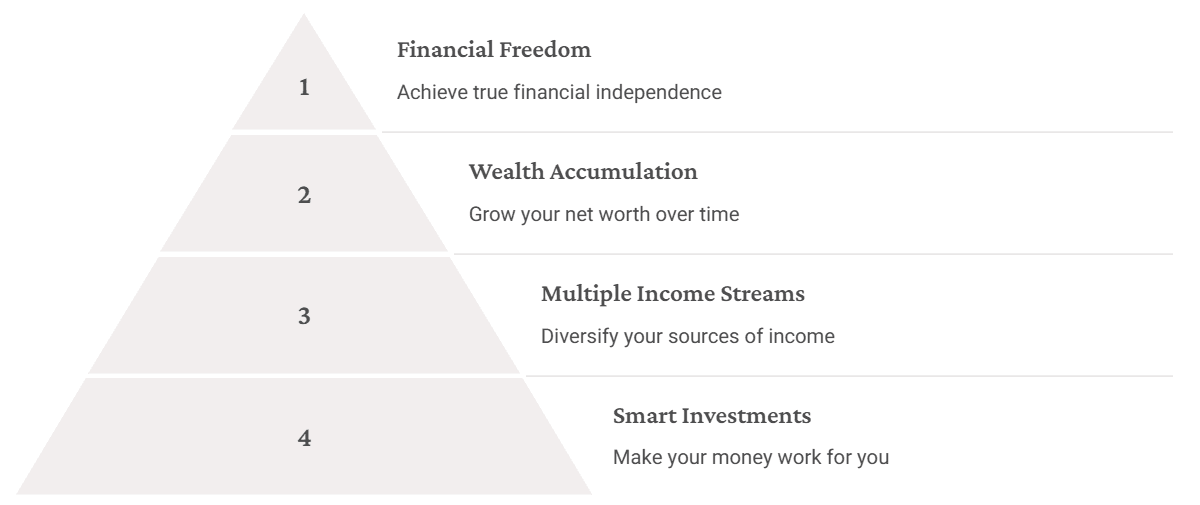

Take Control of Your Financial Future

Shift Your Mindset

Move from working for money to making your money work for you.

Build Passive Income

Create income streams that generate wealth while you sleep.

Master Smart Investments

Learn and apply strategies for effective investing.

Continuous Education

Stay informed about personal finance and market trends.

The Power of Passive Income

Frequently Asked Questions

You can start investing with as little as $100 in some cases. Many online platforms allow you to begin with small amounts in index funds or fractional shares of stocks.

It's never too late to start investing. While starting earlier gives you more time to benefit from compound growth, many successful investors began later in life. The key is to start as soon as possible and be consistent with your investments.

There are many resources available for learning about investing:

- Read books by respected financial authors

- Take online courses on platforms like Coursera or Udemy

- Follow reputable financial blogs and podcasts

- Attend investment seminars or workshops

- Consider working with a financial advisor for personalized guidance

Take Action Today!

1

Start Your Financial Education

Choose a book or course to begin your journey in understanding personal finance and investing.

3

Set Clear Financial Goals

Define what financial freedom means to you and set specific, measurable goals to achieve it.

2

Assess Your Current Finances

Take stock of your income, expenses, and any existing investments or debts.

4

Make Your First Investment

Start small with a low-risk investment to gain experience and confidence in the process.

Don't let another day go by without taking the first step toward a future where money works for you. Your journey to financial freedom starts now!

Join the National Achievers Congress

Want to learn directly from world-renowned financial experts? Join us at the National Achievers Congress Singapore on August 23–24, 2025, held at Marina Bay Sands with Live Streaming via Zoom.

Learn from Global Experts

Gain direct insights and practical strategies from leading financial minds, sharing their proven methods for making money work for you.

Unlock Wealth Strategies

Discover actionable techniques and real success stories that reveal what it truly takes to break free from the paycheck cycle and build lasting wealth.

Expand Your Network

Connect with a diverse global community of entrepreneurs, investors, and wealth builders, fostering valuable relationships and potential collaborations.

Choose Your Experience

Participate face-to-face for an immersive experience or join via hybrid live streaming online from anywhere in the world.

Learn what it really takes to break free from the paycheck cycle and build lasting wealth — and see and learn directly from Robert Kiyosaki himself at the National Achievers Congress Singapore on August 23–24, 2025 at Marina Bay Sands, with live streaming via Zoom. Whether you join face to face or online, you’ll gain practical strategies, hear real success stories, and connect with a global network of entrepreneurs and investors — all in the way that fits your comfort and schedule!

Assess Your Financial Readiness

Curious about where you truly stand financially? Before you fully dive into your wealth journey, take our FREE Financial Readiness Assessment Test.

This quick assessment is designed to help you pinpoint your current financial preparedness, identify any knowledge gaps, and provide you with a personalized roadmap to start building passive income streams and achieving lasting financial independence.

Understand Your Current Position

Gain clarity on your financial strengths and areas that need improvement.

Identify Knowledge Gaps

Discover specific areas in your financial understanding that you can enhance.

Receive a Personalized Roadmap

Get actionable steps tailored to your unique goals for passive income and financial freedom.

Make Today the Day You Break Free

Remember, making money work for you starts with a single decision: to stop living on autopilot and take control of your financial future. Learn, invest, and act today—so you can step off the hamster wheel and start building a life where your money never stops working for you. Your journey to financial freedom begins now.