Understanding Assets and Liabilities

Robert Kiyosaki's Rule

Robert Kiyosaki, the author of Rich Dad Poor Dad, emphasizes one fundamental rule for financial success: Buy assets, not liabilities.

The Impact

Understanding the difference between assets and liabilities and how they impact your financial future is crucial for building wealth.

What Are Assets?

Assets are things that put money in your pocket. They generate income, appreciate in value, or provide financial benefits over time. The key characteristic of an asset is that it contributes to your wealth rather than draining it.

Rental properties

Properties that generate monthly rental income, providing a steady cash flow while potentially appreciating in value over time.

Intellectual property

Books, patents, music, and other creative works that generate royalties and licensing fees for years after their creation.

Stocks and dividends

Shares in companies that pay regular dividends and may increase in value, building wealth through both income and growth.

Businesses with passive income

Enterprises structured to generate revenue with minimal day-to-day involvement, creating income streams that don't require constant attention.

Precious metals and commodities

Physical assets like gold, silver, and other resources that tend to maintain value over time and can hedge against inflation.

What Are Liabilities?

Liabilities, on the other hand, take money out of your pocket. They often come with recurring costs, interest payments, or depreciation, reducing your overall wealth.

Cars

Vehicles typically lose 15-20% of their value each year and come with ongoing maintenance costs, insurance, and fuel expenses.

Non-Income Properties

Mortgages on properties that don't generate rental income create ongoing expenses through payments, taxes, and maintenance.

High-Interest Loans

Personal loans with elevated interest rates that significantly increase the total amount repaid compared to the principal borrowed.

Credit Card Debt

High-interest revolving debt that compounds over time, often costing significantly more than the original purchases.

Student Loans

Long-term education debt that can take decades to repay, often with substantial interest accumulation over time.

The Asset vs. Liability Mindset

Wealth-Building Mindset

People with a wealth-building mindset focus on accumulating assets that generate passive income.

Consumer Mindset

Those stuck in a consumer mindset often acquire liabilities, mistaking them for assets.

Common Misconceptions

Home Ownership

Many people believe that owning a home is an asset, but if the home does not generate income, it is actually a liability due to maintenance, property taxes, and mortgage payments.

Luxury Items

Similarly, luxury items like cars and designer goods are often seen as symbols of wealth, but they lose value over time and do not contribute to financial growth.

How to Start Buying Assets Instead of Liabilities

Educate Yourself

Read books, attend seminars, and learn from financial experts about wealth-building strategies

Track Your Expenses

Identify whether your purchases are assets or liabilities.

Invest Wisely

Prioritize investments that generate passive income and appreciate in value.

Reduce Unnecessary Debt

Avoid high-interest liabilities that drain your finances.

Create Multiple Streams of Income

Diversify your income sources to achieve financial security.

The Power of Education in Financial Decision Making

Continuous Learning

Educating yourself about finance is crucial for making informed decisions about assets and liabilities.

Seminars and Workshops

Attending financial seminars can provide valuable insights from experts in the field.

Practical Application

Applying what you learn to your own finances is key to building wealth.

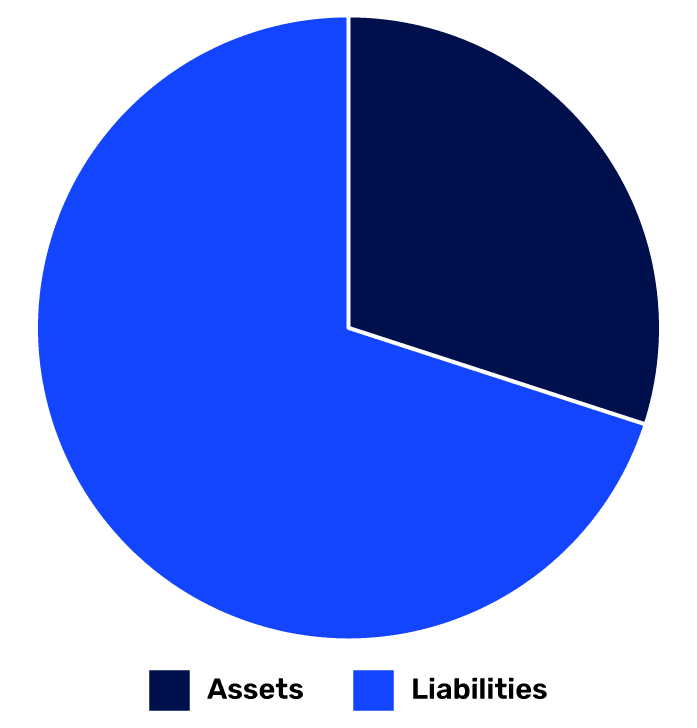

The Impact of Tracking Expenses

This chart illustrates a common expense breakdown for many individuals. By tracking expenses, you can identify areas where you're accumulating liabilities instead of assets. The goal is to increase the percentage of your expenses that go towards acquiring assets.

The Journey to Financial Freedom

Start Tracking

Begin by tracking all your expenses and categorizing them as assets or liabilities.

Reduce Liabilities

Actively work on reducing unnecessary liabilities and high-interest debt.

Invest in Assets

Start investing in assets that generate passive income or appreciate in value.

Diversify Income

Create multiple streams of income to increase financial security.

Achieve Freedom

Reach a point where your passive income from assets exceeds your expenses.

The Mindset Shift That Builds Wealth

Financial Freedom

Every financial decision you make either moves you toward financial freedom or keeps you trapped in financial struggles.

Key to Wealth

Understanding the difference between assets and liabilities is the key to building long-term wealth.

Make Smarter Choices

Are you buying your freedom or your chains? Start making smarter financial choices today!

Learn the principles of Robert Kiyosaki,

the author of 'Rich Dad Poor Dad'

Expert Strategies

Learn proven techniques from Kiyosaki and other global financial leaders on building assets that generate passive income.

Valuable Networking

Connect with driven entrepreneurs and investors who share your passion for financial freedom.

Actionable Tools

Walk away with practical strategies you can implement immediately to transform your financial future.

Want to take your financial education even further? Join us at Cashflow Revolution Malaysia. A two-day immersive event where you’ll play Robert Kiyosaki’s famous Cashflow game, guided by experts, and discover practical strategies to build assets, reduce liabilities, and take control of your personal finance.

It’s Time to Choose Wealth

Every financial choice you make either builds your future or burdens it. The difference between buying an asset and buying a liability could mean the difference between lasting freedom and lifelong struggle. Now that you understand the power of investing in income-generating assets, it’s time to put that knowledge into action.

Take the first step today—assess your current financial standing, learn from the best in the industry, and start building a life driven by assets, not liabilities. Because real freedom isn’t bought—it’s built.