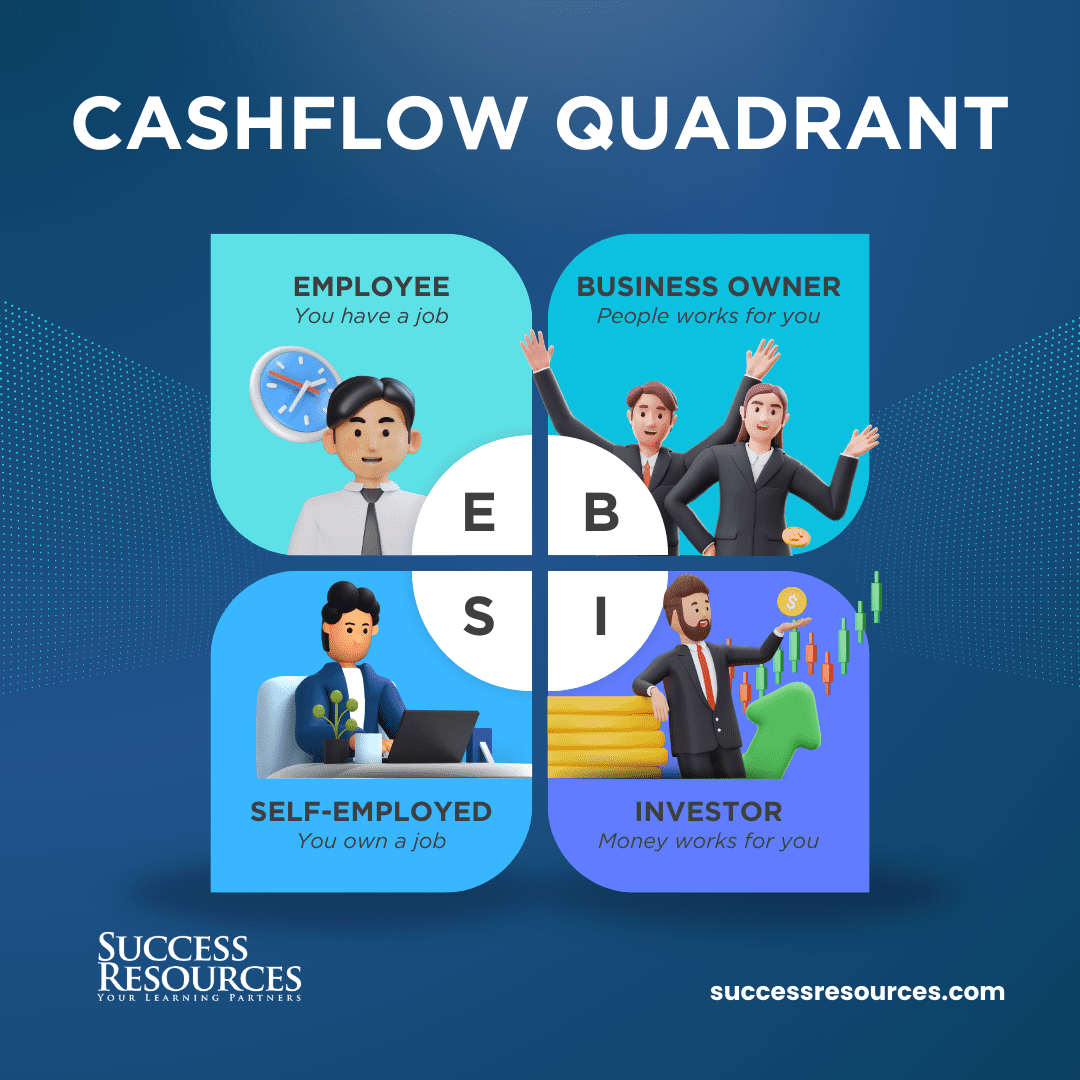

The Cash Flow Quadrant is a financial concept introduced by Robert Kiyosaki in his book 'Rich Dad Poor Dad'. It's a simple yet profound tool that categorizes the different methods individuals earn income. The quadrant is divided into four types of people who make up the world of business: Employees (E), Self-Employed (S), Business Owners (B), and Investors (I). Each quadrant represents a different mindset and approach to work and money, with the ultimate goal of moving from the left side (E and S) to the right side (B and I) to achieve financial freedom.

Understanding the characteristics of each quadrant is essential for recognizing where you currently stand in terms of income generation and what steps you might need to take to transition toward the right side of the quadrant. It's not just about making more money, but about making money work for you.

The Journey from Employee to Self-Employed: A Closer Look

Starting as an employee is the most common entry point in the workforce. Employees trade time for money and rely on their employers for their financial security. The shift from employee to self-employed is often driven by a desire for more control and potentially higher earnings. Self-employed individuals own their jobs, but they're still trading time for money, which can limit their potential for wealth.

To make this transition successful, one must be willing to take on more responsibility, develop a deeper understanding of the market, and be prepared for the unpredictability of self-employment. Time management and the ability to find and retain clients become crucial skills on this journey.

Transitioning to Business Owner: Strategies and Challenges

The shift from self-employed to business owner is marked by the creation of systems and the employment of others. Business owners leverage the time and efforts of their teams to generate income. This transition involves strategic thinking, delegation, and the development of a business that can operate independently of the owner's direct efforts.

It's a challenging move that requires a different mindset, as the focus shifts from working 'in' the business to working 'on' the business. The business owner must navigate the complexities of leadership, operations, and scalability while managing risks and ensuring the business's profitability and sustainability.

Investor Mindset: How to Think for Financial Independence

Investors are at the pinnacle of the Cash Flow Quadrant, where money works for them. This stage is about using the income generated from the B quadrant to invest in assets that provide passive income. The investor mindset is about looking for opportunities where money can grow without active involvement, such as stocks, bonds, real estate, or other investments.

Developing an investor mindset entails learning about different investment strategies, understanding market trends, and becoming financially literate. Investors must be able to assess risks, diversify their investment portfolio, and make informed decisions to secure and grow their wealth.

Applying the Cash Flow Quadrant to Real-Life Scenarios

Applying the principles of the Cash Flow Quadrant to real-life situations requires a thorough self-assessment and a strategic approach to transitioning between quadrants. Whether you're a fresh graduate starting as an employee or a seasoned professional contemplating a shift to self-employment or business ownership, understanding your financial goals and the steps necessary to achieve them is crucial.

Real-life application of the quadrant involves setting clear financial objectives, continually educating oneself on financial matters, and being willing to adapt to changing circumstances. It's not a one-size-fits-all solution, but a flexible framework that can guide individuals towards financial independence and success.