Entrepreneurs vs. Employees: Who Wins in the Long Run?

In today's fast-changing economy, the debate between being an entrepreneur or an employee is more relevant than ever. Some swear by the stability of a 9-to-5 job, while others are drawn to the limitless potential of entrepreneurship. But which path truly leads to financial freedom and long-term success?

According to Robert Kiyosaki, author of Rich Dad Poor Dad, the key to wealth isn't found in traditional employment but in financial education and business ownership. So, is it better to climb the corporate ladder or build your own? Let's break it down.

The Employee Path

Regular paychecks, benefits packages, and job security make employment the conventional choice for many professionals seeking stability in their careers.

The Entrepreneur Route

Freedom, unlimited income potential, and building equity in your own business attract those willing to embrace risk for potentially greater rewards.

The Employee Path

Regular paychecks, benefits packages, and job security make employment the conventional choice for many professionals seeking stability in their careers.

The Entrepreneur Route

Freedom, unlimited income potential, and building equity in your own business attract those willing to embrace risk for potentially greater rewards.

The Employee Mindset: Security and Stability

1

Consistent Income & Benefits

Employees receive a steady paycheck, making financial planning easier. Many jobs also offer perks such as health insurance, paid vacations, and pensions.

2

Less Risk & Responsibility

Unlike entrepreneurs, employees don't have to worry about business failures, market fluctuations, or unstable income streams. Their biggest risk is job loss, which can be mitigated by having an emergency fund or switching employers.

3

Structured Work Environment

Some people thrive in structured environments where expectations are clear. Employees follow set schedules and job roles, reducing decision fatigue.

Downsides of Employment

Limited Financial Growth

Kiyosaki argues that employment has its downsides, including limited financial growth and dependency on a paycheck.

Inflation and Taxes

With inflation and taxes eating away at earnings, employees often struggle to build wealth over time.

The Entrepreneurial Mindset: Freedom and Wealth Creation

Unlimited Income Potential

Unlike a salaried job, entrepreneurship allows you to earn as much as the market is willing to pay. Your income isn't capped, and as your business grows, so do your profits.

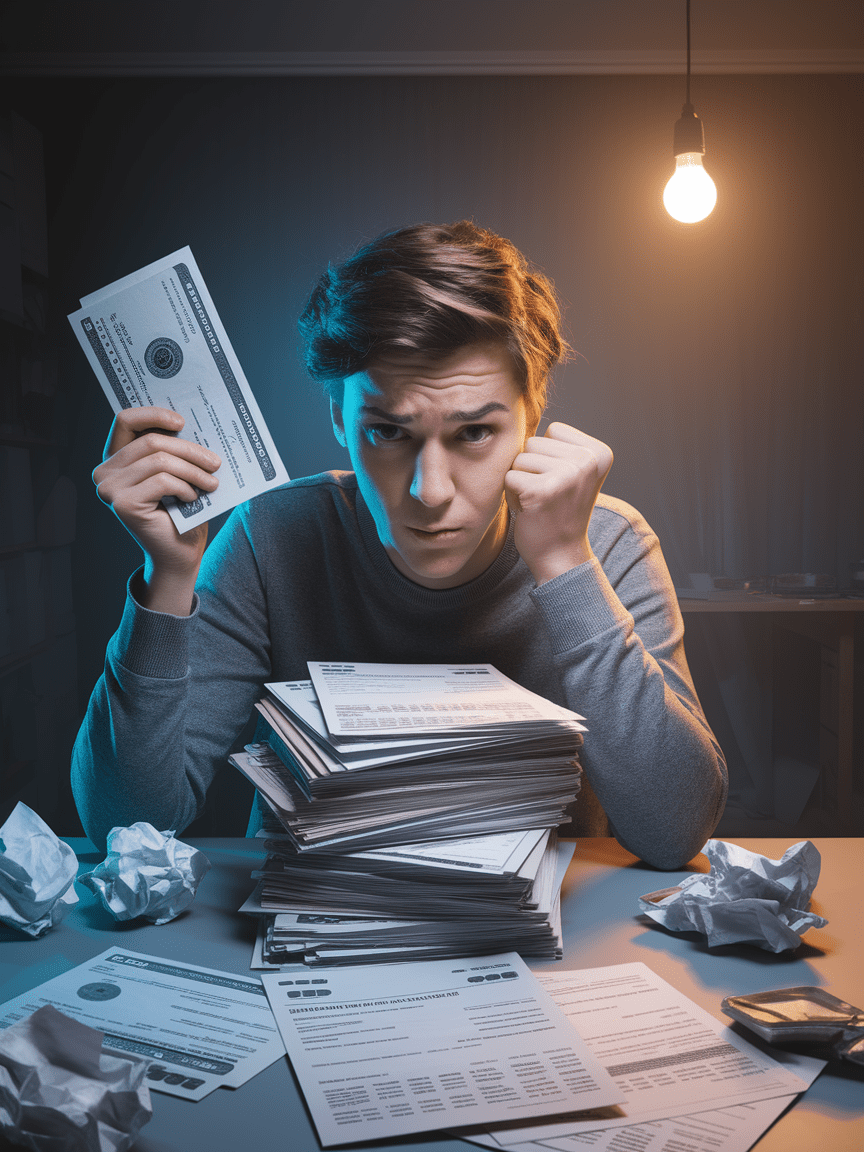

Financial Freedom & Wealth Building

Kiyosaki emphasizes the importance of assets—things that put money in your pocket. Entrepreneurs can build businesses, real estate portfolios, and investments that generate passive income, leading to long-term financial freedom.

Control Over Your Time

Entrepreneurs can design their schedules, work on their passions, and choose their business direction. Over time, they can delegate tasks, creating true time freedom.

Challenges of Entrepreneurship

1

Financial Risk

Entrepreneurship comes with financial risk, as many businesses fail in their early stages.

2

Long Hours

Building a business often requires long hours and personal sacrifices, especially in the beginning.

3

Responsibility

Entrepreneurs bear the burden of responsibility for their business's success or failure.

4

Continuous Learning

Success requires persistence, adaptability, and continuous learning in the face of challenges.

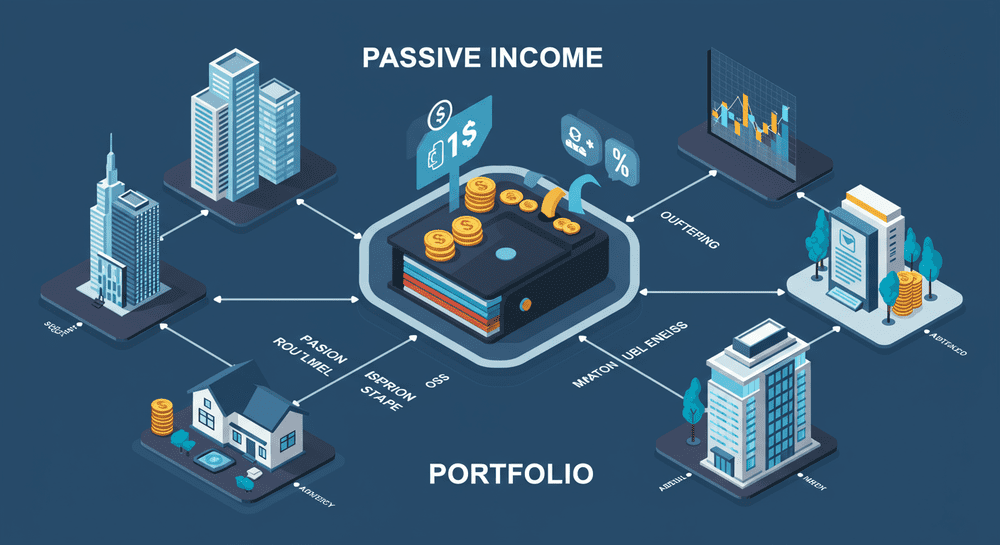

Kiyosaki's Cashflow Quadrant

Employees and self-employed individuals often stay trapped in the left side, while true wealth is built on the right side—through business ownership and investing.

E

(Employee)

Works for someone else, trades time for money.

S

(Self-Employed)

Owns a job (e.g., freelancers, consultants), still trading time for money.

B

(Business Owner)

Builds systems and teams to generate income.

I

(Investor)

Uses money to make money through assets.

Moving from the employee and self-employed quadrants to the business owner and investor quadrants is key to building lasting wealth and financial freedom.

Which Path Is Right for You?

When to Stay an Employee:

When to Pursue Entrepreneurship:

The Best of Both Worlds?

1

2

3

Leverage Your Job

Kiyosaki doesn't dismiss employment entirely but encourages people to use their jobs as a stepping stone.

Build Assets

The smartest move? Leverage your job to build assets. Whether through side businesses, investments, or real estate, the key is shifting from relying on a paycheck to making money work for you.

Financial Education

Invest in your financial education and explore opportunities beyond your paycheck.

The Best of Both Worlds?

1

Leverage Your Job

Kiyosaki doesn't dismiss employment entirely but encourages people to use their jobs as a stepping stone.

2

Build Assets

The smartest move? Leverage your job to build assets. Whether through side businesses, investments, or real estate, the key is shifting from relying on a paycheck to making money work for you.

3

Financial Education

Invest in your financial education and explore opportunities beyond your paycheck.

Take Control of Your Financial Future

Learn Powerful Strategies

Discover wealth-building techniques from financial experts at the National Achievers Congress.

Gain Financial Independence

Move beyond the Employee quadrant toward Business Owner and Investor mindsets.

Make Informed Decisions

Develop the knowledge to evaluate opportunities and build lasting wealth.

Achieve Financial Freedom

Start your Cashflow Revolution and create the life you truly want.

Ready to transform your financial future? Join the National Achievers Congress! This life-changing experience awaits.

Are You Building Wealth or Just Earning a Paycheck?

The path you choose shapes your financial future. While employees rely on stable income, entrepreneurs build long-term wealth. But no matter which path you're on, financial freedom isn't guaranteed—unless you plan for it.

Earning a Paycheck

Most people trade time for money, creating income that stops when they stop working.

Is your money working for you in the long run?

Building Wealth

True financial freedom comes from assets that generate income whether you work or not.

Do you have a strategy to accelerate wealth?

Maximizing Potential

The gap between potential and results often comes down to financial education and planning.

Are you maximizing your earning potential?

Find out where you stand. Take the FREE Cashflow Readiness Assessment today and start building a future on your terms.