The Need for Financial Education

- 1Over 60% of people feel unprepared to manage their money effectively

- 2Nearly 50% avoid investing due to a lack of knowledge

- 3Financial education is still missing from traditional school systems

Lesson 1: The History and Future of Money

- 11971: Removal of Gold Standard

Led to inflation and the need for alternative stores of value

- 22009: Bitcoin's Emergence

Introduced decentralized finance, giving individuals more control over their money

- 32024: Rise of CBDCs

Signals a shift toward government-controlled digital currencies, impacting privacy, inflation, and financial freedom

Lesson 2: Mastering Your Personal Financial Statement

Assets

What you own that generates income

Liabilities

What you owe that costs you money

Income

Money coming in from various sources

Expenses

Money going out to cover costs

Your personal financial statement is your real-life report card. Unlike school grades, banks and investors focus on your assets, liabilities, income, and expenses.

Lesson 3: Assets vs. Liabilities — The Wealth Equation

Assets

Liabilities

Most people think their house or car is an asset, but if it's costing you money, it's a liability. The rich focus on acquiring income-generating assets like rental properties, businesses, and investments.

Lesson 4: Cash Flow vs. Capital Gains

- 1Cash Flow Investing

Owning rental properties that generate monthly income

- 2Capital Gains Investing

Buying a stock, hoping its price increases

- 3Wealthy Focus

Invest for consistent cash flow rather than relying solely on price increases

Lesson 5: The Three Types of Income

- 1Portfolio Income

Money from investments (capital gains, stocks, etc.)

- 2Portfolio Income

Money from investments (capital gains, stocks, etc.)

- 3Earned Income

Money from a job (most heavily taxed)

Building passive income is key to financial freedom. Start creating yours today.

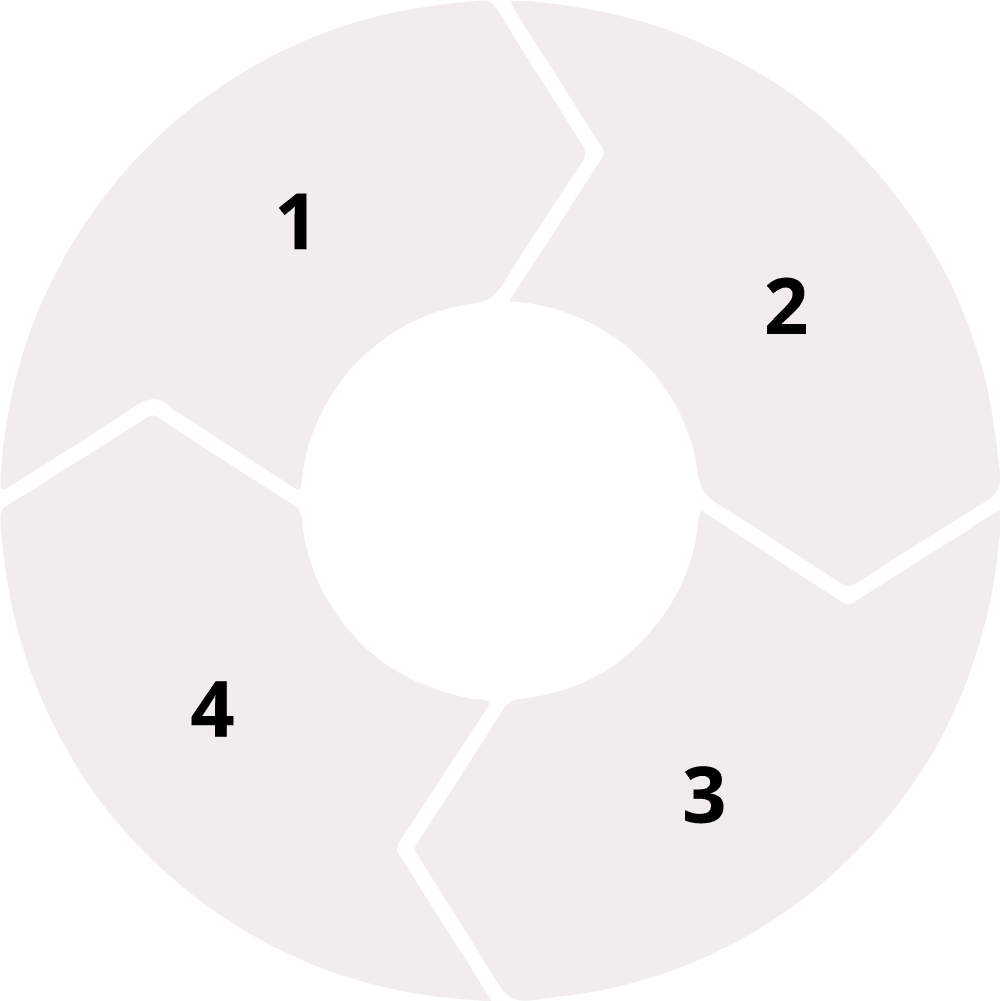

Lesson 6: The CASHFLOW Quadrant

- 1Employees (E)

Work for money

- 4Investors (I)

Make money work for them

- 2Self-Employed (S)

Own a job

- 3Business Owners (B)

Build systems that make money

Which quadrant are you in? Take a moment to reflect and start your journey to financial freedom.

Lesson 6: The CASHFLOW Quadrant

- 1Employees (E)

Work for money

- 2Self-Employed (S)

Own a job

- 3Business Owners (B)

Build systems that make money

- 4Investors (I)

Make money work for them

Which quadrant are you in? Take a moment to reflect and start your journey to financial freedom.

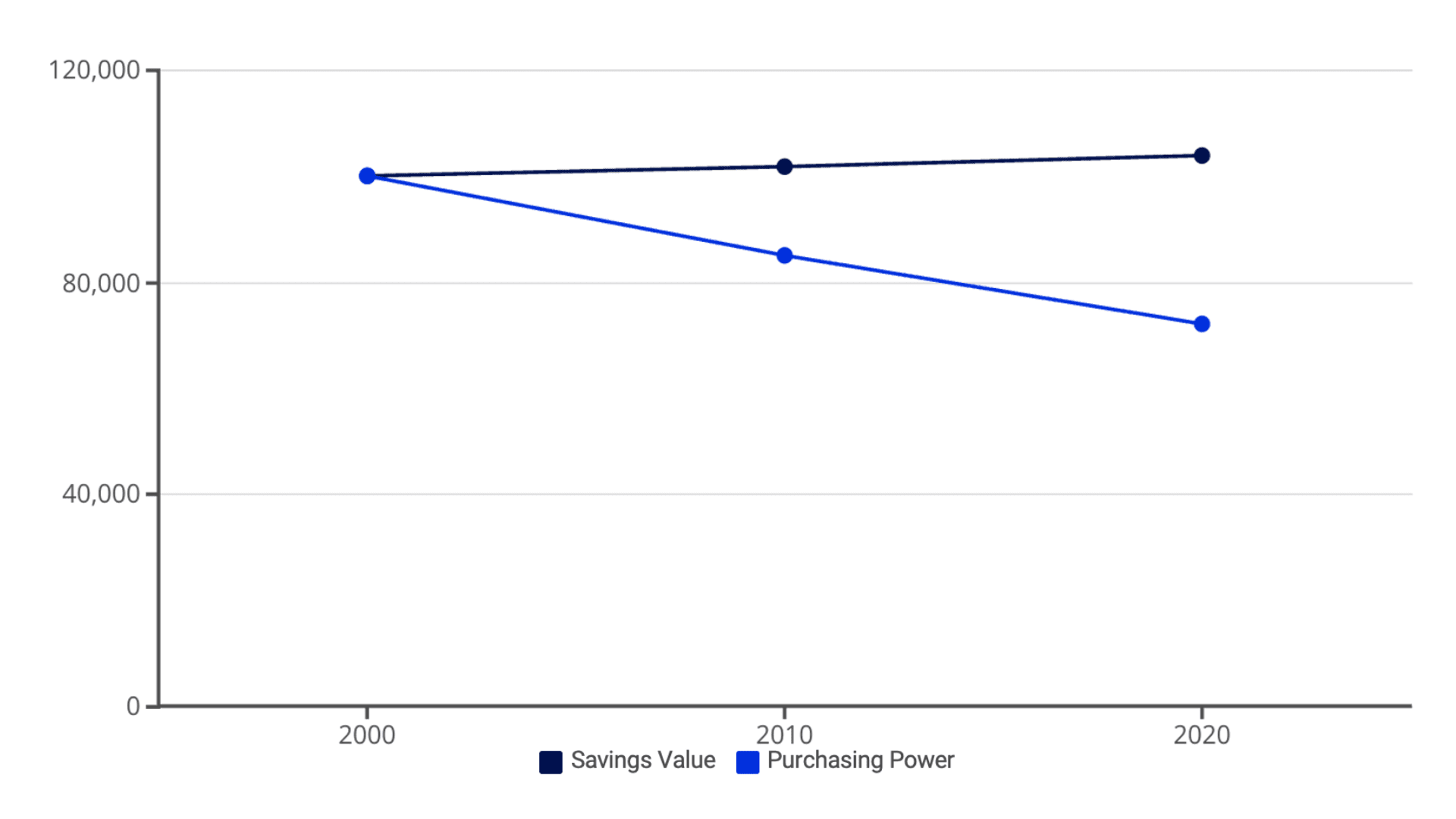

Lesson 7: Why Savers Are Still Losers

Keeping money in a savings account feels safe, but inflation silently eats away at its value. If you had $100,000 in 2000, its purchasing power today is significantly lower. While banks pay minimal interest, the cost of living keeps rising—meaning your savings lose value every year.

Lesson 8: Your Wealth Number

30

Days

Led to inflation and the need for alternative stores of value

365

Days

Goal for financial stability

Days

When passive income exceeds expenses

Your wealth number is how long you can survive financially without working. If your passive income exceeds expenses, your wealth number is infinite.

Lesson 9: Fundamental vs. Technical Investing

Fundamental Investing

Technical Investing

Both methods matter, and you can invest successfully using both—but each requires commitment and continued financial education.

Lesson 10: The 5 Asset Classes for Wealth

- 1Business

Work for money

- 5Digital Assets

Crypto and NFTs offer high-risk, high-reward opportunities in a decentralized world

- 2Real Estate

Rental properties, commercial spaces, and land appreciate in value and generate passive income

- 3Paper Assets

Stocks and bonds allow you to grow wealth through capital appreciation and dividends

- 4Commodities

Hard assets like gold, silver, and oil protect against inflation and serve as a store of value

Lesson 10: The 5 Asset Classes for Wealth

- 1Business

Work for money

- 2Real Estate

Rental properties, commercial spaces, and land appreciate in value and generate passive income

- 3Paper Assets

Stocks and bonds allow you to grow wealth through capital appreciation and dividends

- 4Commodities

Hard assets like gold, silver, and oil protect against inflation and serve as a store of value

- 5Digital Assets

Crypto and NFTs offer high-risk, high-reward opportunities in a decentralized world

Lesson 11: Choosing the Right Partners

Trust

Build relationships based on mutual trust and respect

Complementary Skills

Look for partners whose strengths complement your weaknesses

Shared Vision

Ensure alignment on long-term goals and values

Clear Agreements

Establish clear roles, responsibilities, and expectations

A great idea with the wrong partners can destroy a business. Learn how to identify and choose trustworthy partners to build a strong foundation for success.

Lesson 12: Focus vs. Diversification

- 1New Investors

Focus on one asset class and master it

- 2Experienced Investors

Diversify for stability

- 3Balance

Finding the right balance between focus and diversification is key to long-term success

Lesson 13: Minimizing Investment Risk

Lack of Knowledge

Educate yourself continuously about investment strategies and market trends

Lack of Control

Take an active role in managing your investments and understanding your portfolio

Market Volatility

Develop strategies to adapt to market changes and maintain a long-term perspective

Minimize risk by gaining financial education, managing your investments wisely, and adapting to market changes.

Lesson 14: Making More Money Through Tax Strategies

Understand Tax Laws

Familiarize yourself with current tax regulations and deductions

Maximize Deductions

Identify all eligible business expenses and investment-related deductions

Structure Investments

Use tax-efficient investment vehicles and strategies

Seek Professional Advice

Consult with tax professionals to optimize your tax strategy

Lesson 15: Good Debt vs. Bad Debt

Bad Debt

Good Debt

Good debt, such as loans for income-generating assets like real estate and businesses, helps build wealth. Master the art of leveraging debt wisely.

Lesson 16: The Four Wealth Killers

Taxes

Build relationships based on mutual trust and respect

Complementary Skills

Look for partners whose strengths complement your weaknesses

Shared Vision

Ensure alignment on long-term goals and values

Clear Agreements

Establish clear roles, responsibilities, and expectations

A great idea with the wrong partners can destroy a business. Learn how to identify and choose trustworthy partners to build a strong foundation for success.

Lesson 17: Learning from Mistakes

- 1Make Mistakes

Don't fear failure; it's part of the learning process

- 5Grow

Use your new knowledge to make better financial decisions

- 2Analyze

Reflect on what went wrong and why

- 3Learn

Extract valuable lessons from each experience

- 4Adapt

Adjust your strategies based on what you've learned

The biggest financial success stories are built on failures. The key is learning, adapting, and growing from them.

Lesson 17: Learning from Mistakes

- 1Make Mistakes

Don't fear failure; it's part of the learning process

- 2Make Mistakes

Don't fear failure; it's part of the learning process

- 3Learn

Extract valuable lessons from each experience

- 4Adapt

Adjust your strategies based on what you've learned

- 5Grow

Use your new knowledge to make better financial decisions

The biggest financial success stories are built on failures. The key is learning, adapting, and growing from them.

Final Thoughts: The Importance of Financial Education

- 1Financial education is more important than ever in today's rapidly changing world

- 2AI, crypto, and new investment opportunities are reshaping wealth-building strategies

- 3The best time to start your financial education journey is now

Ready to take control of your financial future? Start your journey today.

Are You Financially Ready for True Freedom?

- 1Identify Gaps

Find any weak spots in your financial knowledge.

- 2Learn Strategies

Learn key strategies to build wealth faster.

- 3Get a Roadmap

Get your own plan for financial success.

Understanding money is just the beginning. How prepared are you?

Take our free Cashflow Readiness Test to find out.