Why Two People Get Different Results With the Same Money

Two people can earn the same income, invest in the same market, and follow identical advice — yet end up in completely different places. Because money isn’t just math. It’s behavior. And what really matters is how you react when uncertainty hits.

Money Is Personal — And That Changes Everything

Morgan Housel's The Psychology of Money challenges finance's biggest myth: that smart people always make smart money decisions. Every financial choice you make filters through your personal experiences — upbringing, past wins, losses, fears, and expectations.

What feels "safe" to one person can feel reckless to another. What looks like opportunity to one investor screams danger to someone else. There is no universal formula for wealth. Your financial decisions are shaped by context, not just logic.

Why Calm Beats Genius in Building Wealth

The Behavior Gap

Panic selling, chasing losses, overreacting to headlines, and trying to time the market perfectly destroy more wealth than bad strategies ever could.

Emotional Discipline

The most successful investors aren't the smartest in the room. They're the ones who stay consistent when everyone else becomes emotional.

Stay the Course

You don't need brilliance to build wealth. You need the ability to remain calm during turbulent times and stick to your plan.

Consistency Beats Complexity

Here's an uncomfortable truth: There is no single "right" way to build wealth. Different people succeed using different strategies because those approaches align with their unique risk tolerance, patience, and emotional comfort.

Simple strategies often outperform complex ones — not because they're smarter, but because they're easier to stick to. Consistency matters more than perfection. Small, ordinary returns compounded over long periods create extraordinary results, but only if you don't interrupt the process.

The Power of Simple

Complexity impresses. Simplicity performs. Choose strategies you can maintain for decades, not quarters.

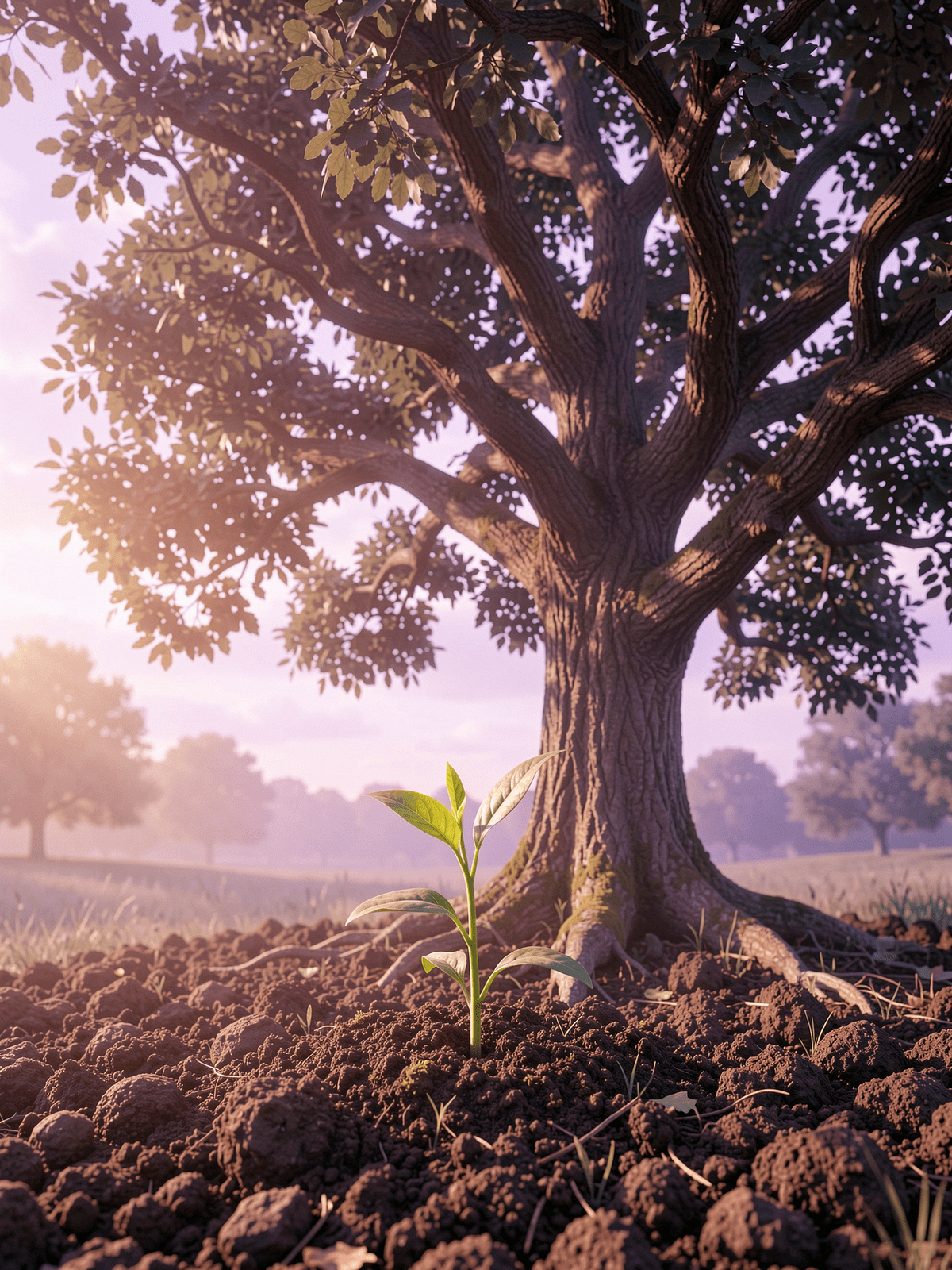

The Hidden Power of Time and Compounding

1

Year 1-5

Growth appears slow. Patience feels difficult. Small gains accumulate quietly.

2

Year 6-15

Momentum builds. Compounding becomes visible. Consistency pays off.

3

Year 16-30

Exponential growth emerges. Time becomes your greatest advantage. Wealth compounds dramatically.

Compounding doesn't need dramatic wins. It needs patience. Wealth grows quietly through small advantages repeated over time. Market volatility isn't a flaw — it's the price of admission for long-term returns. Short-term outcomes are unpredictable. Long-term outcomes reflect behavior.

The Most Underrated Skill in Money: Knowing What's Enough

Many financial disasters don't stem from lack — they come from never knowing when enough is enough. Without a clear definition of "enough," ambition transforms into recklessness. Comparison takes over. Risk escalates unnecessarily.

When you define what "enough" looks like for you, everything changes. You make calmer decisions. You avoid desperation. You protect your freedom instead of chasing endless more. True wealth is often invisible — the money you don't spend, the risks you don't take, the peace you protect.

Wealth Is Built Quietly — Not Loudly

Creates Options

Real wealth gives you choices. The freedom to say no. The ability to choose opportunities aligned with your values.

Creates Time

Wealth buys back your most precious resource. Time with family. Time for passion. Time for what truly matters.

Creates Freedom

True financial success means independence. It's built by people who understand themselves, not just the market.

Money doesn't reward the smartest person. It rewards the most emotionally disciplined one.

Want the Full Breakdown?

This only scratches the surface of the profound insights in The Psychology of Money by Morgan Housel. The behaviors, beliefs, and mental frameworks that shape financial success go much deeper.

Listen to the full audiobook insights on the Success Resources Books Insights YouTube channel to dive deeper into how understanding the psychology behind money helps you stop reacting and start building wealth with intention.