The Passive Income Illusion

"Make money while you sleep!"

You've probably heard this claim before. From rental properties to online courses, passive income is sold as the holy grail of financial freedom—income streams that require little to no effort.

The Reality Check

But here's the reality: passive income isn't truly passive. Whether it's real estate, affiliate marketing, or investing, all these avenues demand time, strategy, and ongoing effort.

The Truth

Even the wealthiest entrepreneurs know that maintaining and growing these revenue streams requires constant optimization.

The Myth of Effortless Income

1

Limited Success

A study by the IRS shows that only about 20% of Americans report earning any form of passive income. The idea that anyone can generate a steady flow of cash without effort is largely a marketing gimmick.

2

Warren Buffett's Wisdom

Even Warren Buffett, one of the biggest advocates for building wealth through investments, famously said, "If you don't find a way to make money while you sleep, you will work until you die." However, what most people forget is that building a sustainable passive income stream takes years of work, strategic planning, and in many cases, active management.

Common Passive Income Misconceptions

The Truth About Financial Independence

Beyond the Hype

If passive income isn't truly passive, what's the best way to approach it? The key is understanding that financial independence isn't about finding a magical money-making machine, but rather building systems that generate income with increasingly less of your direct involvement over time.

Strategic Approach

Passive income is achievable, but it requires smart investments, optimization, and adaptability. The most successful wealth builders don't chase get-rich-quick schemes—they methodically create assets that appreciate and generate returns while developing systems to manage them efficiently.

Realistic Expectations

Setting realistic expectations about the work involved helps you stay committed when challenges arise. Remember that even Warren Buffett, with all his wealth, still spends time reviewing investments and making strategic decisions about his portfolio.

Why Passive Income Requires Work

1

Initial Investment of Time and Money

Building passive income streams often requires upfront work and financial resources. Whether you're writing a book, developing an online course, or investing in dividend stocks, you need either money, time, or both to create a revenue-generating asset.

2

Maintenance and Optimization

Think rental properties run themselves? Think again. From property management to repairs, real estate investors are constantly engaged in upkeep. Similarly, digital entrepreneurs must update content, optimize marketing strategies, and keep up with trends to maintain income flow.

3

Market Risks and Adaptation

No income stream is immune to market changes. Stocks fluctuate, affiliate programs shut down, and online courses lose relevance. True financial independence requires ongoing monitoring and adjustments.

How to Make Passive Income Work for You

Sustainable Passive Income Models

Subscription-based Businesses

Membership sites and SaaS platforms provide recurring revenue with predictable cash flow, though they require ongoing value delivery and customer retention efforts.

Index Fund Investing

Instead of day trading or risky stock picks, index funds offer more stable long-term growth with less active management required.

Evergreen Content

YouTube videos, blogs, or online courses with long-term value can generate income for years, though they require initial creation effort and periodic updates.

Leveraging Automation and Delegation

Identify Repetitive Tasks

The first step to making passive income more hands-off is identifying which tasks are repetitive and can be automated or delegated.

Implement Automation Tools

Use scheduling tools, AI-driven marketing, and automated payment systems to reduce manual work while maintaining business operations.

Strategic Outsourcing

For tasks that can't be automated, consider outsourcing to virtual assistants or specialized professionals to free up your time while ensuring quality.

Regular System Review

Periodically review your automation and delegation systems to identify improvements and ensure they're still serving your business needs effectively.

Expert Strategies for Passive Income

1

Learn from Experts

Attending financial masterclasses like the 100 Points Strategy Masterclass can help you understand realistic wealth-building techniques.

2

Apply Proven Methods

Learning from those who have already navigated the journey can save you from costly mistakes and accelerate your path to success.

3

Adapt to Your Situation

Take expert advice and customize it to your unique financial situation, goals, and available resources.

4

Implement and Iterate

Put strategies into action, measure results, and continuously refine your approach based on real-world performance.

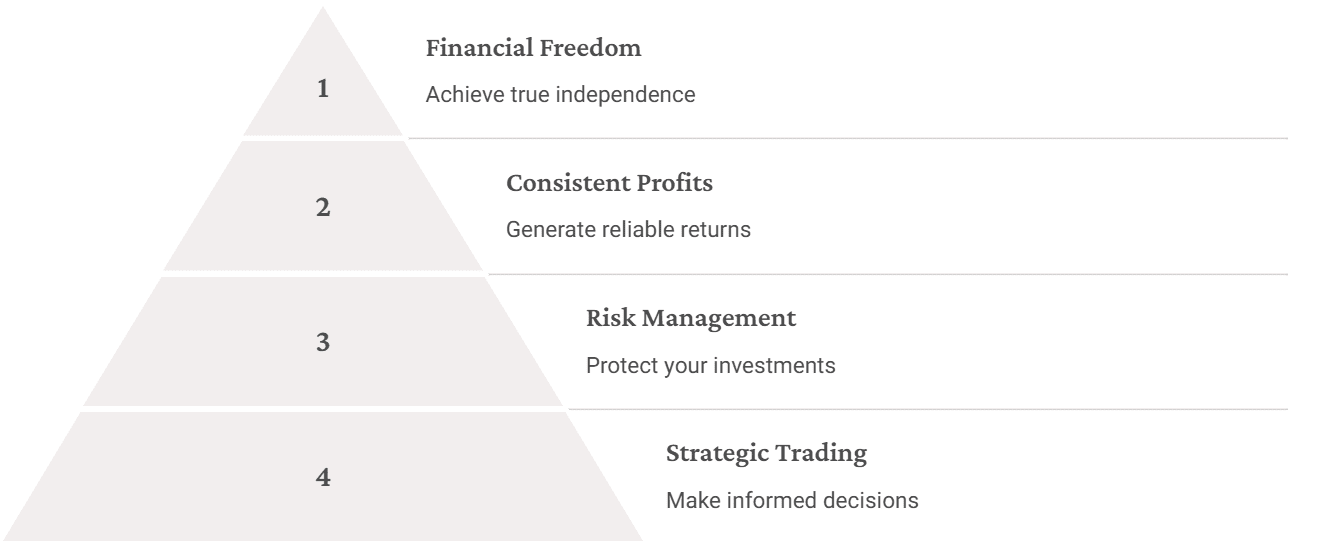

Rethinking Passive Income

According to Robert Kiyosaki, building wealth requires more than just saving money in a bank account.

1 - Shift Your Mindset

Instead of chasing the illusion of effortless money, shift your mindset toward strategic wealth-building.

4 - Build Multiple Streams

Diversify your income sources to create resilience and compound your earnings over time.

2 - Set Realistic Expectations

Understand that passive income requires initial effort and ongoing management, but can provide increasing returns over time.

3 - Focus on Optimization

Continuously improve your systems to reduce the time required while maintaining or increasing revenue.

Rethinking Passive Income

According to Robert Kiyosaki, building wealth requires more than just saving money in a bank account.

1 - Shift Your Mindset

Instead of chasing the illusion of effortless money, shift your mindset toward strategic wealth-building.

4 - Build Multiple Streams

Diversify your income sources to create resilience and compound your earnings over time.

2 - Set Realistic Expectations

Understand that passive income requires initial effort and ongoing management, but can provide increasing returns over time.

3 - Focus on Optimization

Continuously improve your systems to reduce the time required while maintaining or increasing revenue.

Taking Action Today

1

Choose One Stream

Select a single passive income opportunity that aligns with your skills and resources

2

Research Thoroughly

Understand the requirements, potential returns, and maintenance needs

3

Take One Action Step

Make a concrete move toward establishing your chosen income stream

4

Build Consistently

Commit to regular effort until your income stream begins generating returns

Meet Stephen Cheung

Seasoned Entrepreneur

Stephen Cheung is a seasoned entrepreneur and investor with over 20 years of experience in IT, retail sales, and business management.

International Trainer

Having achieved financial freedom through real estate investments across Canada, the US, and the UK, he has coached investors in 14 countries since 2015, sharing strategies on property investment and creative financing.

Balanced Lifestyle

An international trainer and speaker, Stephen has educated thousands of aspiring investors. Now, he enjoys a balanced lifestyle, dedicating minimal time to managing his portfolio while inspiring others to achieve financial independence.

Master the Market with a Proven Strategy

The NDAQ100 market is full of opportunities—but without the right strategy, you're missing out on consistent profits. If you're tired of second-guessing your trades, struggling with market volatility, or feeling stuck in a cycle of wins and losses, it's time for a change.

The 100 Points Strategy Masterclass

1

Premier Trading Program

The 100 Points Strategy Masterclass is your key to trading with confidence, precision, and profitability. Led by seasoned expert Stephen Cheung, this premier program teaches a capital-intensive strategy designed to help traders like you capture consistent gains and minimize risks in today's fast-moving market.

2

Comprehensive Learning Experience

This isn't just education—it's transformation. The market won't wait, and neither should you. Take control of your financial future and secure your spot in the 100 Points Strategy Masterclass today!

What You'll Get from the Masterclass

Interactive Online Course

With unlimited refreshers for 3 months so you can perfect your strategy

Margin Calculator Tool

Take the guesswork out of your trades and calculate risk like a pro

Exclusive Student Support Forum

Get expert guidance and connect with a community of serious traders

Computer-Assisted Trading Program

Setup & Subscription – leverage advanced trading technology to optimize your performance

This isn’t just education—it’s transformation. The market won’t wait, and neither should you. Take control of your financial future and secure your spot in the 100 Points Strategy Masterclass today!

Success Isn't Luck—It's Strategy

100

Success Points

Comprehensive assessment of your readiness for financial success

3

Minutes

Quick assessment that delivers powerful insights

∞

Potential

Unlock your unlimited capacity for wealth creation

You work hard, but are you truly prepared to achieve financial freedom and massive success? The 100-Point Success Readiness Test uncovers what's propelling you forward—or holding you back.

The 100-Point Success Readiness Test Benefits

Personalized Insights

Gain customized recommendations based on your unique situation to supercharge your growth

Strategic Roadmap

Get a clear path forward with actionable steps to make smarter decisions and access bigger opportunities

Reveal Blind Spots

Uncover hidden weaknesses in your financial and success strategy that may be limiting your progress

Confidence Boost

Move forward with certainty knowing exactly where you stand and what you need to improve

The 100-Point Success Readiness Test Benefits

Reveal Blind Spots

Uncover hidden weaknesses in your financial and success strategy that may be limiting your progress

Personalized Insights

Gain customized recommendations based on your unique situation to supercharge your growth

Strategic Roadmap

Get a clear path forward with actionable steps to make smarter decisions and access bigger opportunities

Confidence Boost

Move forward with certainty knowing exactly where you stand and what you need to improve

Are You Ready for Financial Freedom?

If you're serious about success, don't guess—know exactly where you stand. Take the 100-Point Success Readiness Test now! This quick assessment will help you understand which of these critical factors you've mastered and which need improvement to achieve true financial freedom.

Strategy (35%)

The right approach makes all the difference in your journey to financial independence.

Network (5%)

Who you connect with can open doors to new financial opportunities.

Consistency (25%)

Regular, disciplined action creates the foundation for lasting financial success.

Knowledge (20%)

Understanding markets and opportunities empowers smarter financial decisions.

Mindset (15%)

Your beliefs about money and success directly impact your financial outcomes.

Strategy (35%)

The right approach makes all the difference in your journey to financial independence.

Network (5%)

Who you connect with can open doors to new financial opportunities.

Consistency (25%)

Regular, disciplined action creates the foundation for lasting financial success.

Knowledge (20%)

Understanding markets and opportunities empowers smarter financial decisions.

Mindset (15%)

Your beliefs about money and success directly impact your financial outcomes.

Take Action Today

Start Your Journey

Are you ready to build real financial independence? Start by choosing one passive income stream and taking one actionable step today. Let's make passive income work—the right way.

Assess Your Readiness

In just 3 minutes, you'll:

Master Proven Strategies

The 100 Points Strategy Masterclass is your key to trading with confidence, precision, and profitability. Led by seasoned expert Stephen Cheung, this premier program teaches a capital-intensive strategy designed to help traders like you capture consistent gains.