When was the last time someone told you to "save money for a rainy day"?

We’ve all heard it: the age-old advice to stash money in the bank, cut back on expenses, and live below your means. But what if everything you’ve been told about saving money is wrong? What if saving money is actually keeping you broke?

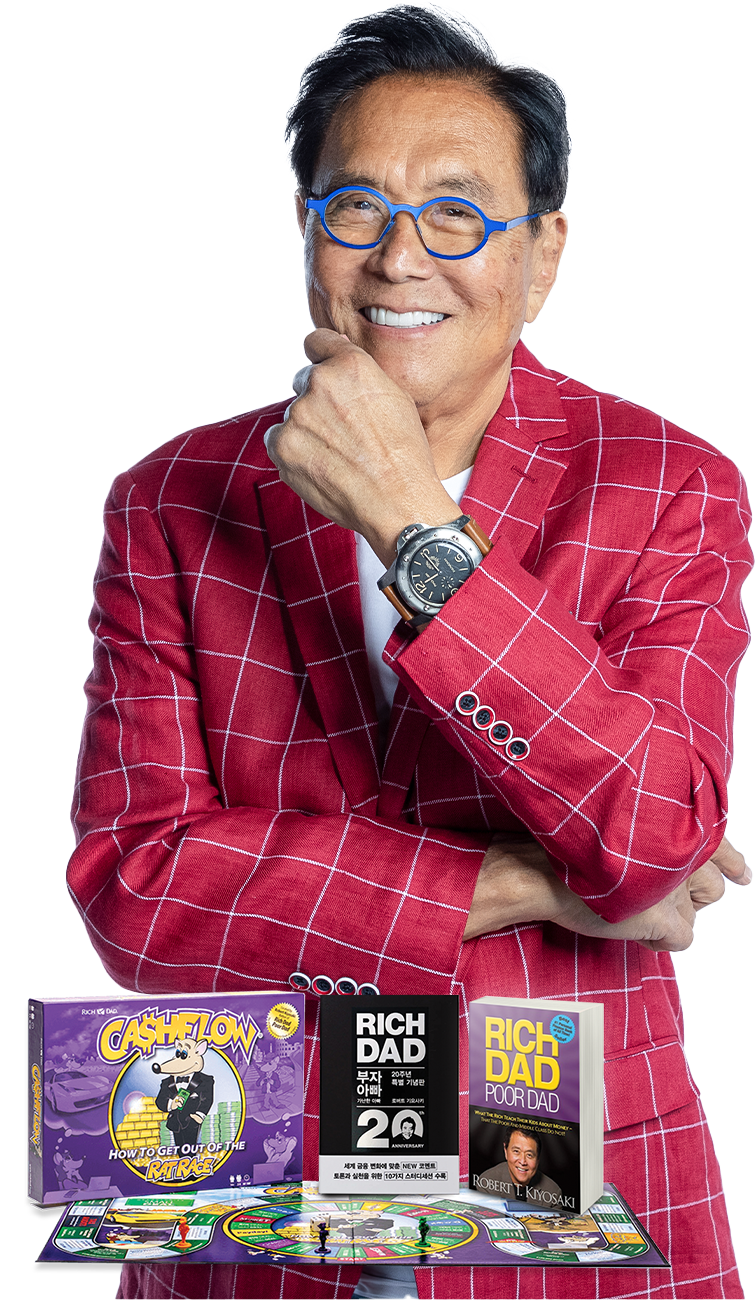

Robert Kiyosaki, the financial expert behind Rich Dad Poor Dad, challenges the traditional belief that saving money is the key to financial security. According to Kiyosaki, simply saving money is a surefire way to stay poor. Let’s explore why Kiyosaki believes this and how you can build wealth in smarter ways.

The Hidden Costs of Saving

Inflation

The problem with traditional savings is that inflation eats away at your money. While your savings might grow by 0.5% in an average bank account, inflation may be running at 3% or higher, meaning your money’s real value is shrinking. So, instead of growing wealth, you’re losing it.

Taxes

Taxes also reduce the value of savings. Whether it’s the interest on your savings account or gains from investments, taxes can significantly eat into your returns. In the end, savings accounts don’t stand a chance against inflation and taxes, leaving your money stagnant.

Why Kiyosaki Says Saving Won't Make You Wealthy

According to Robert Kiyosaki, building wealth requires more than just saving money in a bank account.

1 - Money Works For You

The rich don't work for money - money works for them through investments

2 - Invest in Assets

Wealth is built by investing in income-generating assets, not by saving

3 - Real Estate Focus

Properties generate rental income while appreciating over time

1 - Money Works For You

The rich don't work for money - money works for them through investments

2 - Invest in Assets

Wealth is built by investing in income-generating assets, not by saving

3 - Real Estate Focus

Properties generate rental income while appreciating over time

Kiyosaki's wealth-building philosophy focuses on creating passive income streams rather than simply accumulating savings that lose value to inflation and taxes.

The Power of Cash Flow

$

Income Generation

Cash flow is central to Kiyosaki’s teachings. Focus on creating consistent income streams.

This can come from rental properties or stock dividends. A business you own can also generate cash flow.

Consider a rental property earning $1,000 monthly. After expenses, you net $500.

The property's value may also increase over time. This is a smarter way to build wealth, compared to a savings account.

Kiyosaki’s Recommendations

1

Invest in Income-Generating Assets

Instead of saving money, Kiyosaki recommends investing in assets that generate income. This can be real estate, stocks that pay dividends, or even a business. These investments generate cash flow and appreciate over time, allowing you to build wealth.

2

Create Multiple Streams of Income

Relying solely on a paycheck is risky. Kiyosaki advocates for creating multiple streams of income. Whether it’s side businesses, investments, or other sources of passive income, diversifying your revenue streams can provide financial security.

3

Get Financially Educated

Financial education is key to understanding how to make money work for you. Kiyosaki believes in continuous learning, whether through books, seminars, or advice from successful investors. The more educated you are, the better equipped you’ll be to spot wealth-building opportunities.

4

Use Leverage

Leverage allows you to control assets without using all your own money. For instance, taking out a mortgage to buy real estate enables you to generate rental income and let others help pay off the mortgage. Over time, the property may increase in value, providing you with equity.

5

Invest in Mindset

Finally, Kiyosaki emphasizes developing a mindset that embraces growth and opportunity. By focusing on wealth-building opportunities and taking calculated risks, you can create the life of financial freedom that many people only dream about.

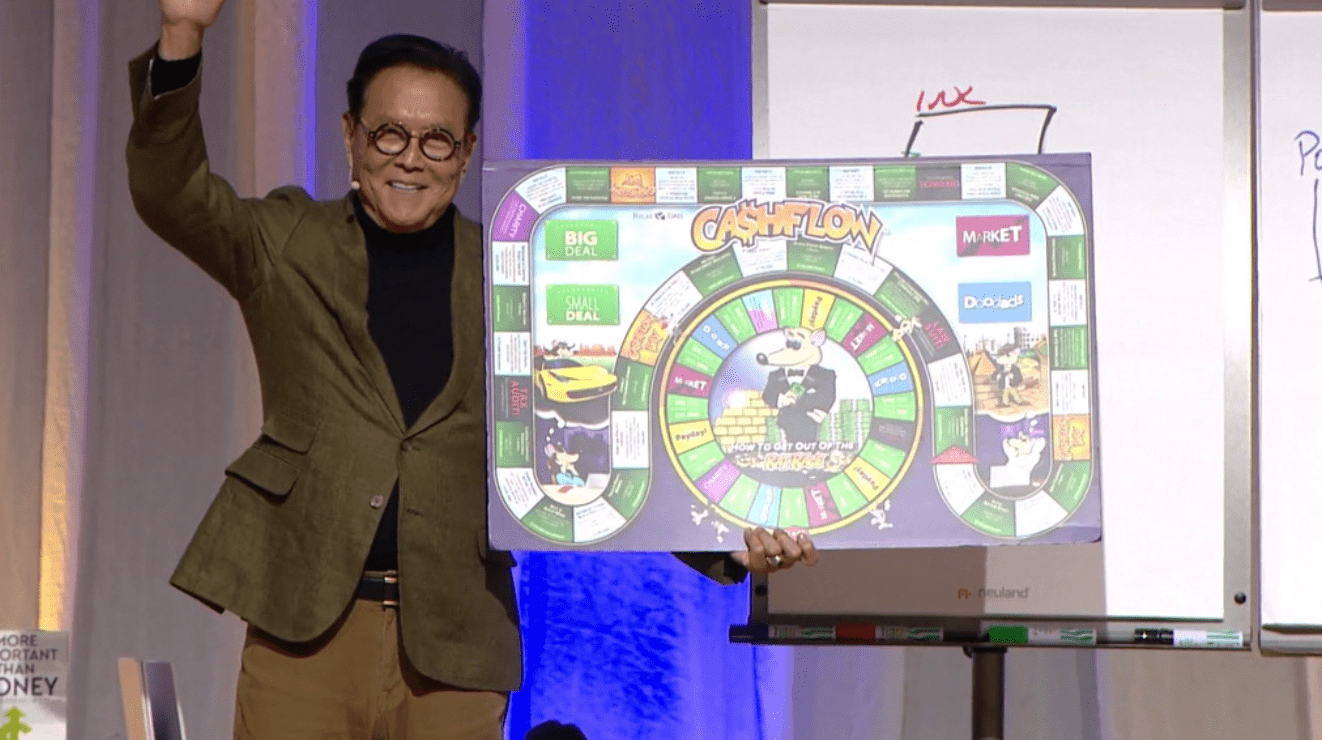

Real-World Example: Kiyosaki’s Journey

Kiyosaki didn’t amass his wealth by saving money in the bank. Instead, he invested in real estate and businesses, leveraging assets to generate cash flow. One of his key moves was promoting the Cashflow game, which helped him connect with a broader audience and expand his wealth-building strategies.

Through his own experiences, Kiyosaki shows that saving money alone won’t lead to financial freedom. You need to put your money to work and focus on assets that generate income.

Kiyosaki’s Journey

1

Early Struggles

Kiyosaki faced financial hardships. He learned from failures and embraced entrepreneurship.

2

Real Estate

He invested in real estate. Kiyosaki built a portfolio of income-generating properties.

3

Business Ventures

He started multiple businesses. Kiyosaki diversified income streams and built wealth. One of his key moves was promoting the Cashflow game, which helped him connect with a broader audience and expand his wealth-building strategies.

4

Financial Independence

He achieved financial freedom. Kiyosaki now teaches others to build wealth.

Rethink Your Saving Strategy

Instead of saving, focus on building assets that produce cash flow. Instead of saving, focus on building assets that produce cash flow.

1 - Educate Yourself

Learn about finance.

4 - Build Cash Flow

Generate income.

2 - Invest Wisely

Choose assets in real estate or businesses.

3 - Manage Risk

Diversify portfolio.

1 - Educate Yourself

Learn about finance.

2 - Invest Wisely

Choose assets in real estate or businesses.

3 - Manage Risk

Diversify portfolio.

4 - Build Cash Flow

Generate income.

Key Takeaways

Savings Alone Aren't Enough

Inflation and taxes erode savings' value. Saving is just one part of financial strategy.

Cash Flow is Crucial

Assets generate income and appreciate. Building cash flow leads to financial freedom.

Financial Education is Essential

Learn about investing and assets. Knowledge empowers you to make informed decisions.

Next Steps

1

Invest

Start Now

2

Learn

Continue Your Financial Education

3

Plan

Develop a Financial Road Map

It's time to take control of your financial future and secure your long-term prosperity.

Next Steps

1 - Invest

Start Now

2 - Learn

Continue Your Financial Education

3 - Plan

Develop a Financial Road Map

It's time to take control of your financial future and secure your long-term prosperity.

Ready to Transform Your Future? Join the National Achievers Congress!

The National Achievers Congress (NAC) isn’t just an event—it’s a life-changing experience designed to equip you with the strategies, mindset, and connections to elevate your financial success.

Why Attend NAC?

This is your moment. Don’t miss out on this exclusive opportunity to learn from the best and take control of your financial future.

Secure Your Spot Now: Click Here to Register

Financial Freedom Test

Take our FREE Financial Freedom Test. Discover your mindset, growth areas, and next steps on your path to financial independence.

Financial Freedom Test

Take our FREE Financial Freedom Test. Discover your mindset, growth areas, and next steps on your path to financial independence.